Budding Australian producer Hillgrove Resources is strategically placed to play a meaningful role in a new era of copper demand.

With a proven leadership team and disciplined growth strategy as it wraps up the first year of commercial production at its flagship Kanmantoo mine in South Australia, Hillgrove is aiming for mid-tier copper producer status to fill the void left by parties such as Oz Minerals and the soon to be MAC Limited.

"We've set a clear strategic ambition: to transform from a single-asset operator into a mid-tier, multi-asset copper producer," managing director and CEO Bob Fulker explains.

"This vision aligns with global market dynamics that increasingly reward companies with scale, diversification, and production resilience.

To achieve this, we are actively progressing along two parallel tracks: organic growth through existing asset development and exploration, and inorganic growth through targeted acquisitions and partnerships."

Leverage, upside and opportunity

Hillgrove has leverage to rising red metal prices and is one of the few on the ASX that can capitalise on this in the near-term, amid a spate of copper company acquisitions.

The miner has significant exploration upside and Fulker says the recent 96% boost to contained copper and 138% increase in gold in this year's resource estimate – to 150,000t and 82,000oz respectively – is "only the beginning".

The company also has strong infrastructure in place to capitalise on growth opportunities – including a 3.6Mtpa processing plant that is currently 40% utilised, a tailings storage facility with spare permitted capacity and access to grid-connected power supply with high reliability and low energy costs.

Record metrics

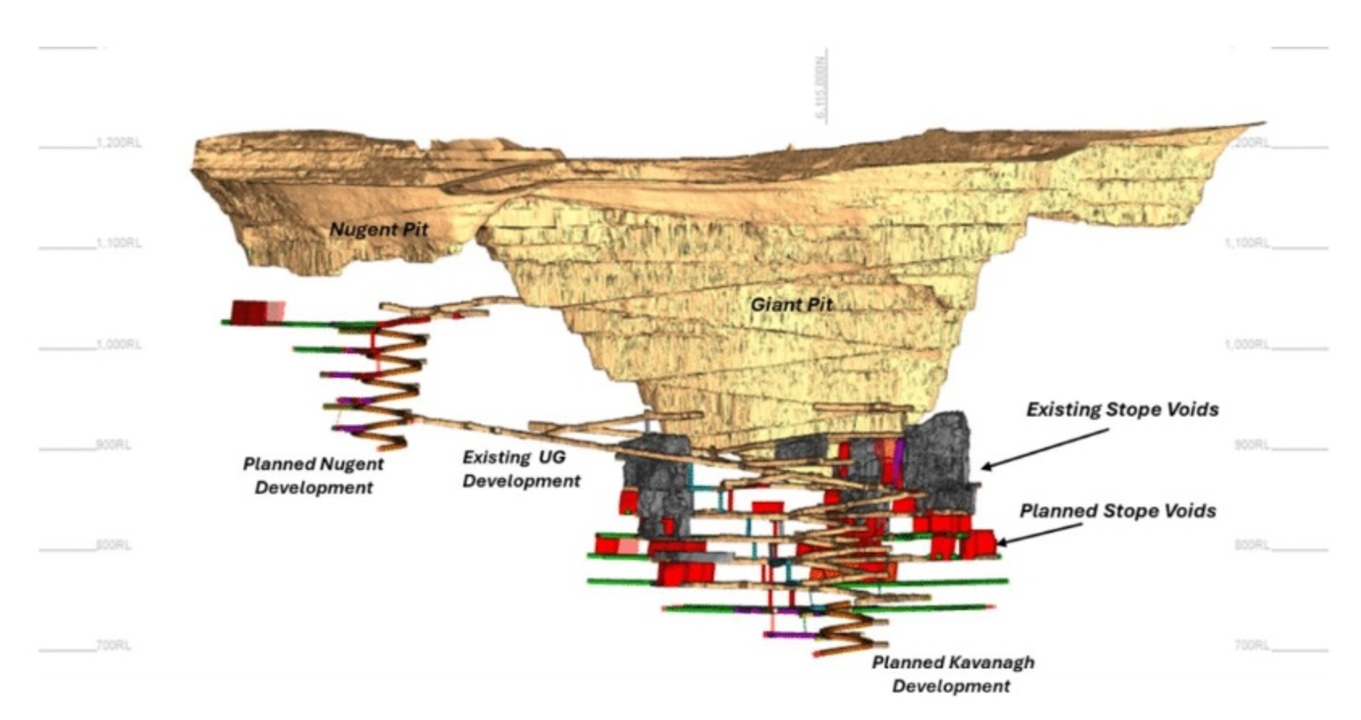

Hillgrove notched up record mining metrics in May and is expecting, at the time of print, to meet 2025 guidance of 12,000-14,000 tonnes of copper production – with a view of increasing this from 1.4Mtpa up to 1.8Mtpa run rate in the first half of 2026, as it brings on the Nugent orebody online.

The company is on track to achieving this milestone, with it already accessing ore from Nugent ahead of schedule in June. This will provide additional copper revenue realising economies of scale at a high level of fixed costs with strong cashflow generation.

Fulker believes the momentum will not only be sustained but improved over the coming quarters.

"As development continues and more headings become available, we expect our ability to maintain and even increase production levels will be enhanced," he said.

He said accelerating development into Nugent increased the number of available work areas, improving flexibility, reducing operational risk and improving economics by enhancing ore availability and production reliability.

"This development is a critical enabler for the long-term success of the Kanmantoo Underground operation and underpins our broader objective of establishing a robust, scalable, and cost-effective copper production platform in South Australia," he said.

Compelling case

Fulker brings leadership capabilities and experience built over a four-decade career in the resources sector, including senior roles with Evolution Mining and OZ Minerals.

"Central to this is a philosophy of strategic operational excellence, coupled with a strong emphasis on leadership, accountability, and a culture of continuous improvement," he said.

"While many of these foundational elements were already present at Hillgrove before my arrival, I believe I've been able to elevate them further in the short time I've been here – helping to instil a high-performance culture that aligns with our ambition to become a leading mid-tier copper producer."

Fulker was drawn to Hillgrove, saying what he discovered about Kanmantoo's geology when doing due diligence was "genuinely compelling".

"There is indeed real opportunity here – both in terms of scale and mine life extension," he said.

This upside was demonstrated again in late June, with down plunge drilling results from Kavanagh intercepting copper mineralisation 200m below the existing resource.

An updated resource estimate is slated for the December quarter.

Copper bull

Meanwhile copper demand is soaring thanks to its role in the global shift towards a low-carbon economy.

Solar and wind energy generation alone are set to drive an additional 1Mt of copper demand by 2040, compared with the base case, according to a recent Wood Mackenzie report.

"To put the scale of the copper challenge in perspective: humanity has mined copper for roughly 5,000 years, taking us from the Stone Age into the Bronze Age," Fulker said.

"And now, within just the next 30 years, we need to mine the same amount of copper again to meet global electrification targets."

Despite long-standing forecasts highlighting the need for additional supply, few major projects have materialised, and Fulker said the market was now seeing the result – structural undersupply and supportive pricing.

"With this context, I am of course very much a copper bull and think that it is an exceptional time to be developing and growing a copper business," he said.

"And Hillgrove is strongly positioned to play a meaningful role in this new era for copper."

Growth pathway

Fulker said Hillgrove's organic growth front included Kanmantoo's exploration potential, accelerating Nugent and the under-utilised processing plant.

Inorganic options to explore "at the right time" included toll treating or feedstock agreements and acquiring producing copper assets.

"We believe Hillgrove represents a highly compelling investment opportunity, particularly when assessed against our sector peers," he said.

He expects to see a market re-rate as Hillgrove delivers on its strategic milestones including results from the 60,000m drilling program, resource update and ongoing development of the Nugent orebody.

"The months ahead are expected to be transformational," he said.

"Together, these milestones are poised to crystallise value, de-risk the business, and increase investor visibility, while further strengthening Hillgrove's positioning as an emerging mid-tier copper producer in a Tier-1 jurisdiction.

"As copper demand continues to rise on the back of global electrification and supply remains constrained, we believe Hillgrove offers a differentiated and timely opportunity for investors seeking quality exposure to the copper thematic."

ABOUT THIS COMPANY

Hillgrove Resources

Head Office Address: Ground Floor, 5-7 King William Road, Unley South Australia 5061

Tel: +61 8 7070 1698

Email: ir@hillgroveresources.com.au

Web: https://www.hillgroveresources.com.au/

Directors

Derek Carter

Bob Fulker

Murray Boyte

Roger Higgins

Market Capitalisation (at July 3, 2025): A$110 million

Quoted shares on issue (ASX: HGO): 2.6 billion

Major Shareholders: Freepoint Metals and Concentrates 18.7%; Ariadne Australia 10.3%