The stage is set for Ballard Mining managing director Paul Brennan to introduce the ASX's newest gold play at Diggers & Dealers this year.

The gold-focused spin-off from Delta Lithium was on track, at the time of writing, to list on the ASX on July 14.

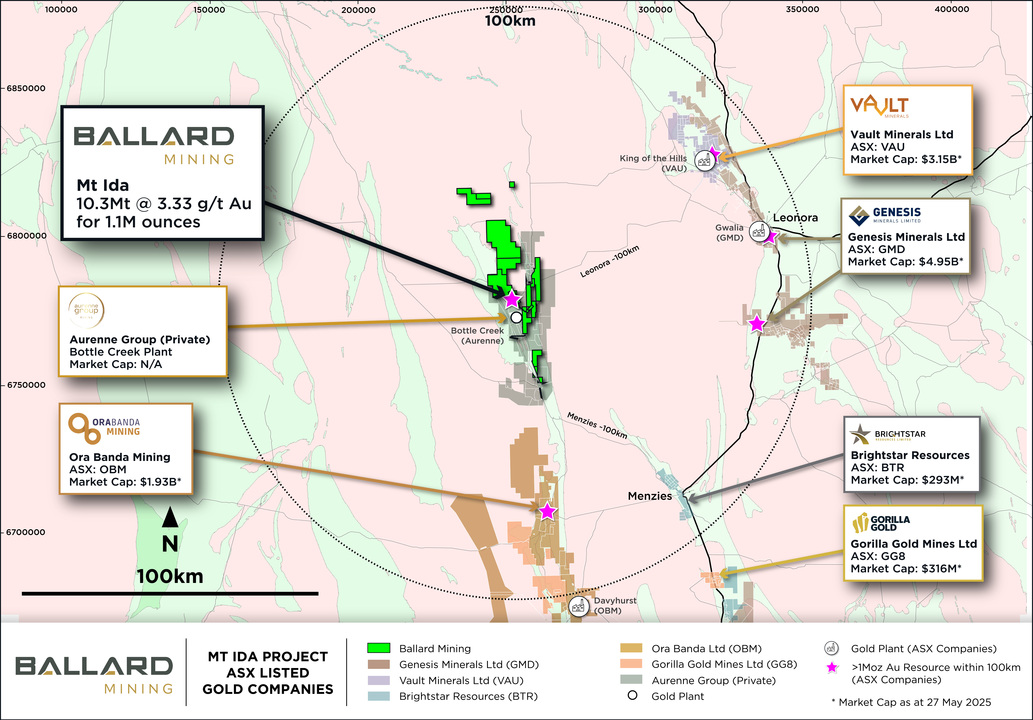

With an experienced team and a 1.1 million ounce resource grading 3.3g/t gold at its Mt Ida project in Western Australia's Goldfields, Ballard is planning to use its circa A$30 million IPO funding to pursue a dual stream growth and development path.

"I'm excited to be able to be part of the next phase which is to grow and ultimately develop the project," Brennan said.

Flying start

Mt Ida spans more than 150sq.km about 100km northwest of Menzies, with the bulk of the project's resource contained in the Baldock deposit.

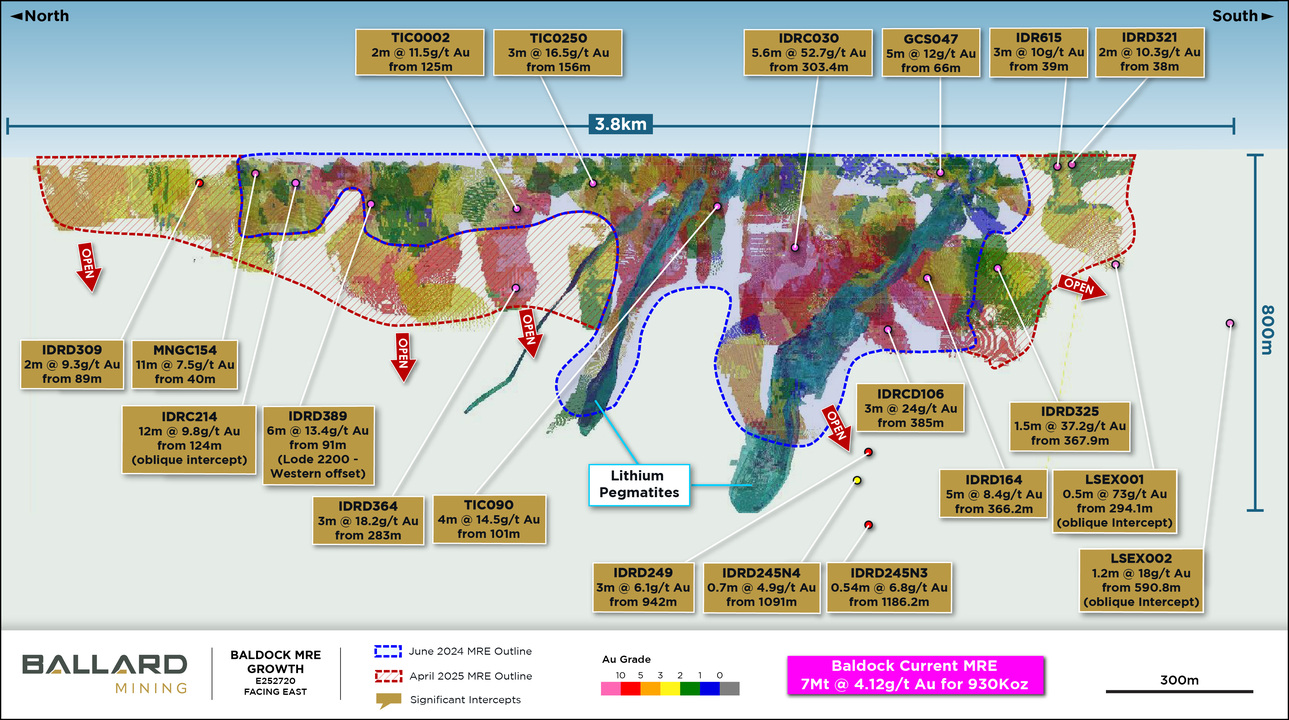

Baldock's resource was upgraded by Delta in April to 7Mt at 4.1g/t gold for 930,000oz and it remains open at depth and along strike.

"We're coming out of the starting blocks with a 1.1Moz high grade resource, on granted mining leases, fully permitted for open pit and underground mining at Baldock and a progressed application to build a standalone processing plant," Brennan said.

"Under Delta ownership and prior to the demerger of Mt Ida into Ballard, the Delta team has been quietly de-risking Mt Ida and now we've had the great reveal on the advanced status of the project."

"We're well funded and have completed reconnaissance to a level we are ready to commence with the rotary lie detector test to understand the potential exploration upside."

Talented team

Brennan is part of a highly experienced team of explorers, developers and operators behind Ballard.

Chairman Simon Lill successfully navigated explorer De Grey Mining from a sub-$1M market cap company through to a $5 billion takeover by Northern Star.

Stuart Mathews brings his experience as recently retired executive vice president of international gold major Gold Fields Australia.

Executive director Tim Manners was CFO for seven years during a transformational period at Ramelius Resources.

And well-respected mining executive James Croser rounds out the board, representing Ballard's major shareholder Delta.

"I like working with competent people who don't take themselves too seriously," Brennan said.

"My technical background is underground gold and I've been involved in a number of new mine start-ups, including building processing plants and non-processing infrastructure."

"Some of these projects have been highly successful, others not as successful but you wear those scars proudly and learn from it."

He was also quick to praise the talented site-based team, "who have had boots on ground for a number of years whilst exploring for lithium under Delta, and so Ballard starts with an advanced level of in-house IP."

First order of business

In terms of growth, the company has planned a 50,000m exploration program over a 26km prospective shear zone that's been under-explored for the past 20 years with previous drilling averaging a depth of just 43m.

"The site team has already identified approximately 20 walk-up drill targets for gold and will now have the funds available to systematically look for the next Baldock," Brennan said.

"The team is excited and that's a good pub test for the potential exploration upside, the conviction is already there."

"On the development front, we have an 80,000 drill metre program planned to de-risk Baldock."

This is set to include extensional drilling and infill drilling to convert the inferred resource to indicated, as well as collect samples for key modifying factors of geotechnical and metallurgical test work.

Aiming for FID

Brennan is aiming to be at a final investment decision to develop the project within the next two years.

"We know what we need to do and we've now got the funds to do it," he said.

"Now it's executing what we said we're going to do."

He expects the growth and development work streams to start coming together within the next 12 months.

"Ideally with the Baldock infill drilling, we'll have delineated a 400,000-500,000oz reserve which will provide the base load feed for the operation over the first five to six years of the mine life," he said.

"With exploration success, we hope that we would be starting to have visibility towards a 10-year plan."

"I'm told the old rule of thumb of a 100,000oz per year production profile for 10 years to provide market relevance and scale is now 80,000koz for 8 years, so the latter would be our initial target for 12 months from now."

"Longer term, our plan is to develop the project, we just need to add a few years' mine life to overcome the capex hurdle and continue to de-risk ahead of an FID."

Strong support

Brennan described an outstanding level of support for Ballard's IPO, due in part to the company and project's credentials, strong gold sentiment, plus a series of gold mergers that created a vacuum and sent funds looking for smaller cap companies to invest in.

"We've been fortunate that we've been able to build a share register to build a mine, and if we have the success we are planning for, there will be a mine built at Mt Ida."

ABOUT THIS COMPANY

Ballard Mining

ABOUT THIS COMPANY

Ballard Mining

HEAD OFFICE

Level 2, 18 Richardson Street

West Perth WA 6005

Telephone: +61 8 6109 0104

Email: info@ballardmining.com.au

Web: www.ballardmining.com.au

Socials: LinkedIn

DIRECTORS

Simon Lill

Paul Brennan

Tim Manners

Stuart Mathews

James Croser

MAJOR SHAREHOLDERS:

Delta Lithium 41.4%, Aurenne Group 9.6%, Hancock Prospecting 5.6%

Mineral Resources 5.1%, Board and management 5.4%

QUOTED SHARES ON ISSUE: 222.04 million

MARKET CAP (at January 28,2026): A$218.71 million