The united team at Cyclone Metals is focused on delivering key milestones in the coming year as the junior works with iron ore major Vale towards developing its high-grade Iron Bear project in Canada.

In a landmark two-phase development agreement signed in February, Vale will provide up to US$138 million to earn 75% of Iron Bear in the iron ore heartland of the Labrador Trough.

The funds will see the 16.7 billion tonne resource through to a decision to mine, hinging on a successful transition to phase two slated for mid-2026.

A prefeasibility study is due in April, after an August scoping study outlined an economically robust 18-year mine with preproduction capex of $4.6 billion and a post-tax NPV8 of $9.8 billion.

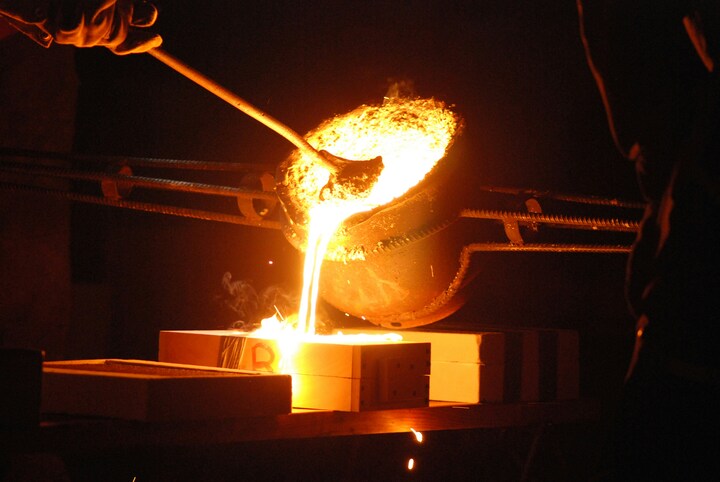

Importantly, Cyclone has already demonstrated that Iron Bear's low-impurity orebody can produce a blast furnace concentrate, direct reduction (DR) magnetite concentrate – and high-value DR pellets, which enable low-carbon or "green" steel making.

Currently only three companies globally produce DR pellets for the seaborne market – Rio Tinto's Iron Ore Company of Canada, Vale and Samarco, Vale's joint venture with BHP.

Cyclone CEO and managing director Paul Berend is keen to join their ranks, given the high-premium DR pellet market is expected to grow almost 50% in the next decade due to the availability of low-cost natural gas and decarbonising initiatives in the steelmaking sector.

"I can report the derisking studies – including the power, rail, port and environmental studies – are all complete," Berend said.

The PFS, led by global engineering firm Hatch, was on track for April and "progressing well".

It's being developed in accordance with the Association for the Advancement of Cost Engineering International standards.

"It's much more than a conventional PFS so it's a huge piece of work which involves Vale at every step, we're in the major league now," Berend said.

In the coming year, Cyclone intends to prioritise building constructive and mutually beneficial relationships with the five local First Nations groups.

"That's very important to us, not just because of the environmental and ethical aspects but ultimately, for this to be successful, this needs to become their project too," Berend said.

The company also plans to build a small pilot plant in Schefferville to generate product and conduct test work on dry tailings, and start on a bankable feasibility study as the project enters the next phase of development.

Uplift anticipated

Berend said Cyclone's share price had suffered from recent board turbulence but he was confident of an uplift, thanks to the team's focus on taking Iron Bear forward.

"Cyclone has been a junior churning projects and now the focus is on developing our flagship project and it's a vision the board is very supportive of," he said.

"We can produce high-purity, direct reduction pellets that sell at a premium of up to $125/t compared to conventional iron ore and it's a market that's expected to grow.

"Combining that with access to low-cost hydropower and existing infrastructure, you've got a very compelling, very profitable project and on the back of that, we can roll out an incredibly sustainable mining operation.

"And last but not least, there's no dilution – we're cashed up, the project is fully funded by Vale and that means there's a buying opportunity right now."

ABOUT THIS COMPANY

Cyclone Metals

HEAD OFFICE:

- 32 Harrogate St, West Leederville WA 6007

- Phone: +61 8 9380 955

- Email: admin@cyclonemetals.com

- Web: https://cyclonemetals.com/

- LinkedIn: https://www.linkedin.com/company/cyclone-metals/

DIRECTORS:

- Tony Sage

- Paul Berend

- Luke Martino

- David Sanders

- Timothy Turner

QUOTED SHARES ON ISSUE: 1.11 billion

MARKET CAP (at November 28, 2025): A$71.89 million