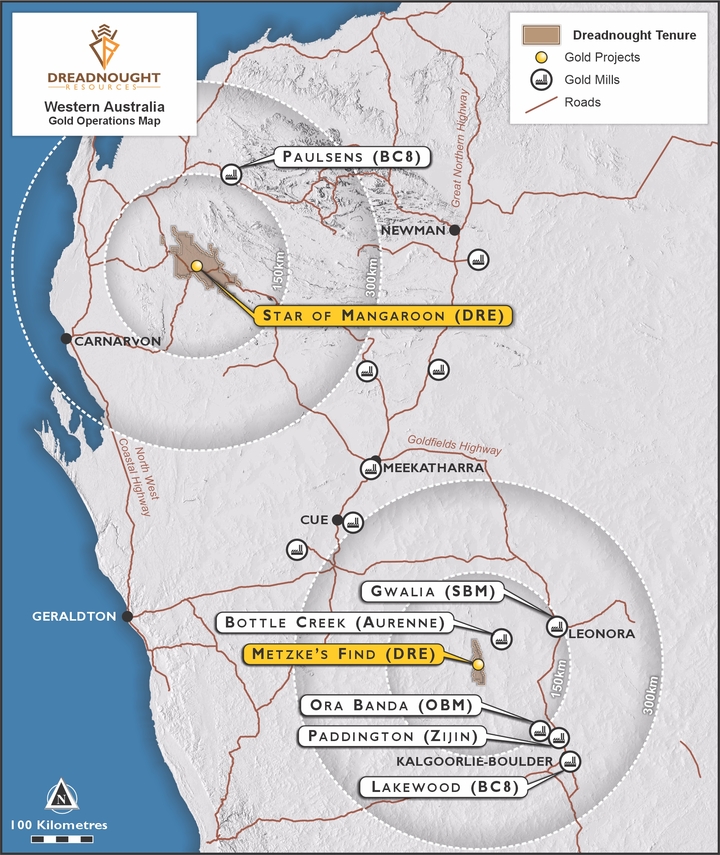

Gold-focused Dreadnought Resources is excited to return to the potential at its high-grade Metzke's Find deposit in the Goldfields, as it nears production at Star of Mangaroon in the Gascoyne.

Managing director Dean Tuck says the time is right, to investigate both the potential for near-term production of high-grade dirt at Metzke's, and the scale of prospectivity at the broader Illaara project.

"Illaara is one of the least-drilled greenstone belts in the Yilgarn Craton, and we are about to embark on the first ever air core program across the belt – the sort of program that led to the Hemi, Gruyere and Tropicana discoveries," he said.

Metzke's Find currently hosts 14,900 ounces at 6.8g/t. It was discovered in 1911 and produced about 1,000oz at 40g/t but it's slipped to the backburner several times over the years, with its remote location and lack of fresh water hindering early miners.

Newmont acquired the project in 2016, attracted by a 55km long gold-arsenic-antimony anomaly, but a change of focus meant its planned major drilling program didn't eventuate.

Dreadnought acquired the project about five years ago when gold was worth around A$2,600/oz and produced impressive gold intercepts including 4m at 19.9g/t from 45m and 3m at 21g/t from 85m. But then soon after the company made its Yin rare earths discovery.

"Gold prices have nearly tripled since then, the market for outsourcing mining, haulage and processing has grown significantly – and Metzke's fits very nicely into that model," Tuck said.

It also ties into Dreadnought's "finding more gold, faster" strategy, which was supported in an $18 million capital raising last month.

Tuck put support down to the potential of a life-changing gold discovery at Mangaroon and Illaara, and Dreadnought's critical metal opportunity at Gifford Creek.

"It was also underpinned by our commitments to bring Star of Mangaroon into production, as well as advance Metzke's Find to help fund those endeavours," he said.

Dreadnought has now submitted a mining lease application for Metzke's Find, for an openpit mine and haulage operation to a third-party mill.

Star set to shine

Dreadnought is aiming for first production at Star of Mangaroon in early 2026.

The initial production target is 24,000oz at 8.3g/t, according to an upgraded study released last month, subject to expansion from extensional drilling.

All-in sustaining costs were estimated at $2,020/oz, well below the current gold price of $6,200oz.

Extensional drilling results recently returned 2m at 28.7g/t within 4m at 14.6g/t from 99m, and the mineralisation remains open at depth and to the north.

More drilling results are expected in the coming weeks, from extensional drilling at Star of Mangaroon, Pritchard's Well mining lease, exploration at three of the project's camp-scale prospects, plus Gifford Creek's Stinger REE and niobium target.

Alongside bringing Star of Mangaroon into production, Dreadnought will advance Metzke's Find towards mining, build its target pipeline – and ideally deliver a gold discovery at Mangaroon and Illaara, Tuck said.

"Illaara is one of the most underexplored greenstone belts in the Yilgarn and nearly every greenstone belt contains a million-ounce deposit – if there is a major gold deposit at Illaara, it is sitting there waiting to be drilled," he said.

The company will also start a metallurgical program to assess Stinger's potential for critical metals and test its high-grade REE target.

"The team is pretty stoked with our progress but we've got a lot of work ahead of us," Tuck said.

"It's a very exciting opportunity for our shareholders."

ABOUT THIS COMPANY

Dreadnought Resources Ltd

Dreadnought Resources (ASX: DRE) is an active West Australian explorer with a portfolio spanning gold, critical and base metals.

ABOUT THIS COMPANY

Dreadnought Resources Ltd

HEAD OFFICE

Unit 1, 4 Burgay Court

Osborne Park WA 6017

Telephone: (08) 9473 8345

Email: info@dreres.com.au

Web: www.dreadnoughtresources.com.au

Sign up to the Dreadnought InvestorHub for direct access to news, results and project updates as they happen: https://dreadnoughtresources.com.au/auth/signup

DIRECTORS

Paul Chapman

Dean Tuck

Philip Crutchfield KC

QUOTED SHARES ON ISSUE (ASX: DRE) 5.64 billion

MARKET CAP (at February 3, 2026) A$141.06 million