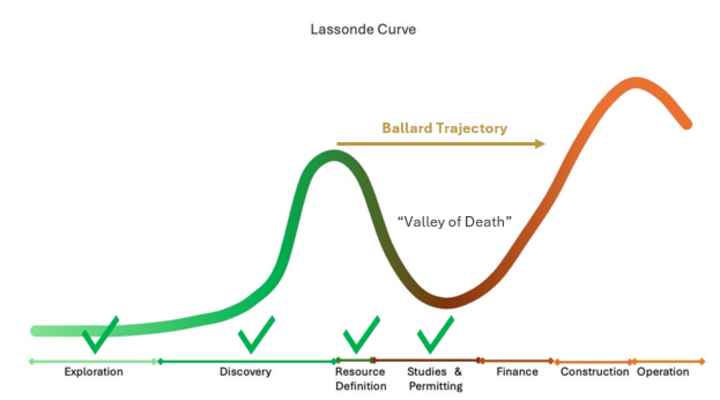

The experienced team behind recently-listed explorer Ballard Mining is looking to leap the Lassonde Curve, as it pursues its dual stream strategies of growth and development at its flagship 1.1 million ounce Mt Ida gold project in Western Australia.

Renowned mining investor Pierre Lassonde created the curve as a visual tool showing the path to value creation by junior gold companies, with a typical downturn in the studies and permitting phase.

What sets Ballard Mining apart is that Mt Ida, about 100km north of Menzies, is now fully permitted for mining and processing after receiving the final tick this month for a 2 million tonne per annum Process Plant and tailings storage facility.

"I think investors are getting an appreciation of how big a deal it is to get a project fully permitted," managing director Paul Brennan said.

"We're working on discovery with our ‘growth' work stream, but are already ticking off important boxes like resource definition, studies and permitting with our ‘development' work stream.

"Once we have enough ounces for a standalone project, we will go straight over the top of the curve's ‘valley of death' to finance and construction."

The company is making rapid progress after demerging from Delta Lithium in a successful A$30 million IPO and listing on the ASX in mid-July.

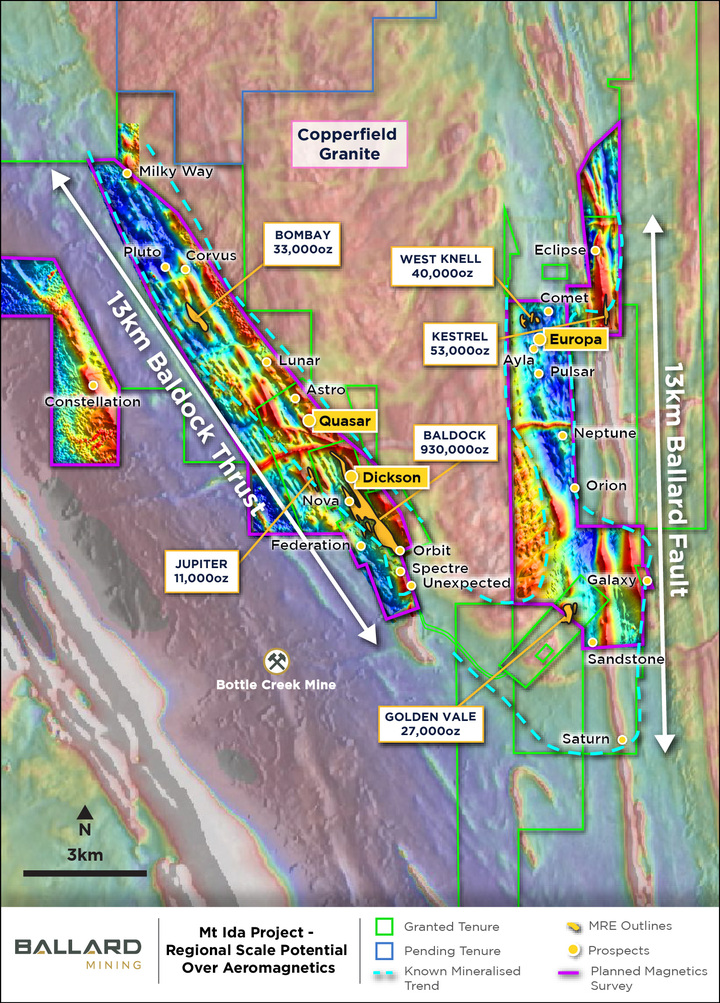

With permitting secured, Ballard's next development target is an initial reserve of up to 500,000oz by mid-2026 at the key Baldock deposit, where the current resource contains 930,000oz at 4.1g/t.

The infill program at Baldock is 70% complete and expected to wrap up in November.

Ballard will then focus on the growth arm of its dual strategy, through a targeted regional exploration program designed to add ounces and support a 10-year standalone gold operation.

Triple the targets

The Ballard team is excited by Mt Ida's emerging camp-scale potential.

A review of high-resolution aeromagnetic images by well-regarded geologist Dr Sarah Jones, announced this week, has trebled the number of gold targets.

The review identified 35 new targets on top of Ballard's initial 18 that were based on historic workings and high-grade rock chip samples.

Initial exploration results announced this week included 8m at 1.8g/t at the Astro target and 1m at 17.6g/t from 29m at Dickson.

Ballard has also identified a plus-900m mineralised trend at the Astro and Quasar prospects, believed to be a northern extension of the 1,100m Dickson mineralised trend.

Brennan said the company was being disciplined with its exploration spend and an electromagnetic survey would help refine planned deeper drilling targets.

"We've got a really good team and everyone's up and about, so it's an exciting time," he said.

"Our focus is on adding ounces."

Ideally Ballard would establish 1.5-2Moz within the next 18 months, and production could begin as early as FY29.

The progress comes as the gold price has hit all-time highs above US$4,100/oz and A$6,400/oz this week.

With millions in the bank, an experienced team, drilling success and an underexplored greenstone belt at its fingertips, Ballard is well-placed to derisk Mt Ida's development.

ABOUT THIS COMPANY

Ballard Mining

ABOUT THIS COMPANY

Ballard Mining

HEAD OFFICE

Level 2, 18 Richardson Street

West Perth WA 6005

Telephone: +61 8 6109 0104

Email: info@ballardmining.com.au

Web: www.ballardmining.com.au

Socials: LinkedIn

DIRECTORS

Simon Lill

Paul Brennan

Tim Manners

Stuart Mathews

James Croser

MAJOR SHAREHOLDERS:

Delta Lithium 41.4%, Aurenne Group 9.6%, Hancock Prospecting 5.6%

Mineral Resources 5.1%, Board and management 5.4%

QUOTED SHARES ON ISSUE: 222.04 million

MARKET CAP (at January 28,2026): A$218.71 million