When Australian Gold and Copper managing director Glen Diemar sees the Sydney Harbour Bridge, he pictures the scale of AGC's Achilles silver-gold dominant discovery in New South Wales.

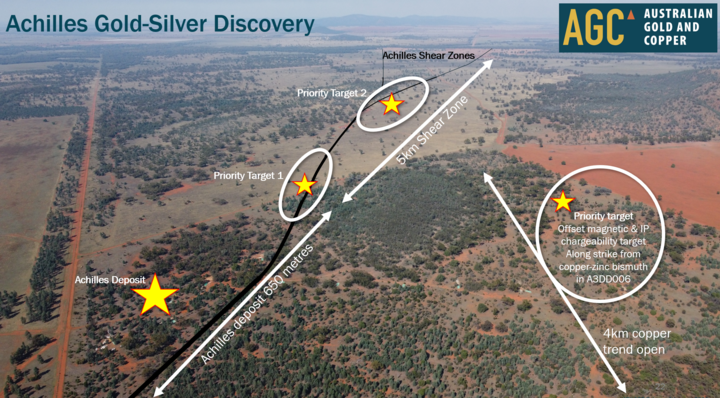

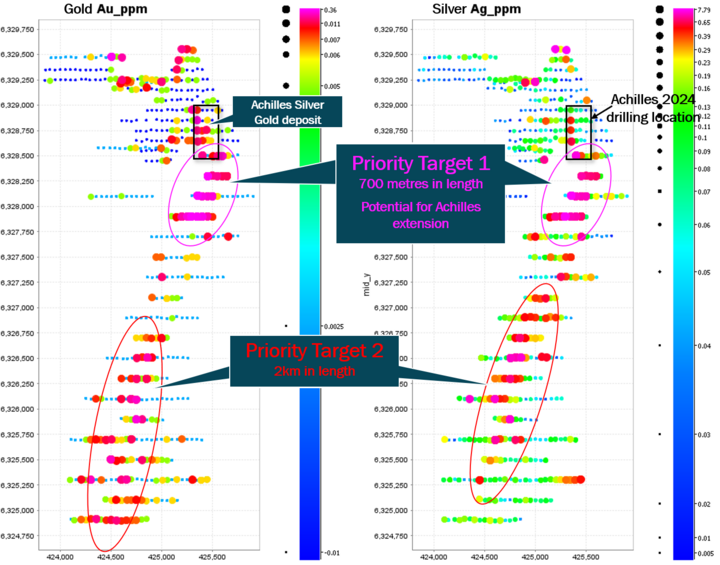

Achilles' mineralisation spans about 700m to 300m deep to date, and AGC is rapidly working towards a maiden resource before year-end.

Despite the comparison to the iconic bridge's size, Diemar believes Achilles could soon be overshadowed by the adjacent Browns Reef project, which AGC is acquiring from Eastern Metals in an expansion making it the dominant titleholder in the South Cobar.

Browns Reef has more than 24,000m of previous drilling and high-grade polymetallic intercepts along a 6.5km strike length, about 10 times the length of Achilles.

"Browns Reef has the potential to be the largest panel of mineralisation within the Cobar Basin," Diemar said.

"We've consolidated the whole South Cobar belt around us."

The company is capitalising on its discovery success to drive towards establishing a substantial silver-dominant inventory in the medium term.

Silver standout

The Achilles discovery is just one of the strengths that makes this well-funded explorer, which debuted on the ASX in 2021, stand out in a rising silver market.

Silver hit a 14-year high above US$40/oz earlier this month and analysts tip silver to rally further, given the gold/silver ratio is up around 90, well above the modern average of circa 60:1.

"We're one of the few silver-dominant Australian explorers on the ASX, that's a point of difference," Diemar says.

The company started the second half with A$14 million in the bank, has a cohesive board and is backed by its major shareholder who's committed to maintaining a 55% stake by participating in future raises.

It means AGC can fund large-scale drilling programs, to delineate Achilles' initial resource and test extension and regional targets.

The discovery in May last year was defined by its fourth drill hole into the deposit which returned 5m at 16.9g/t Au, 1,667g/t Ag, 0.4% Cu, 15.0% Pb+Zn or 3,666g/t silver-equivalent from 112m.

Despite typically strong silver, AGC reported its best gold intercept to date at Achilles earlier this month – 5m at 19.1g/t gold, 52g/t silver, 1.3% lead and zinc – or 1,851g/t silver-equivalent, from only 30m. That was within 42m at 2.6g/t Au, 12g/t Ag, 0.7% Pb+Zn or 266g/t silver-equivalent from 26m.

The company continues to drill and has many assay results pending.

Bold step-out drilling continues, and a second rig has started RC testing on the southern Achilles Shear Zone, looking for a second discovery and making the geology team "one of the busiest on the East Coast".

AGC will then turn its attention to its two recent value-accretive acquisitions, Browns Reef and a 270sq.km exploration licence showing similar geological prospectivity to Achilles.

Meanwhile the company is building its local presence and appreciating the world-class mining jurisdiction.

AGC sponsors the local AFL, netball and rugby clubs and Diemar said his family helped present sporting awards on the weekend.

"It's really nice to be part of the community," he said.

"Being close to the project means we can go out on weekends and spend time with our workers and the landholders and indigenous friends as well."

AGC has neatly overcome the three key hurdles that Diemar believes determine whether shareholders will do well – namely discovery risk, confidence in the ability to raise funds and limiting dilution.

"Our cornerstone investor means our funding model is quite unique – we don't just rely on brokers and the backing means we can focus on the medium-term," Diemar said.

"We're building our business, not short-term hype."

ABOUT THIS COMPANY

Australian Gold and Copper

ABOUT THIS COMPANY

Australian Gold and Copper

HEAD OFFICE

Level 2, 22 Mount Street

Perth WA 6000

Telephone: +61 (0)8 6188 8181

Email: info@austgoldcopper.com.au

Web: www.austgoldcopper.com.au

SOCIALS

LinkedIn: AGC LinkedIn

X: AGC on X

DIRECTORS

Zhang Yong

Adam McKinnon

Glen Diemar

Pan (Joe) Yang

MAJOR SHAREHOLDERS

GeoZen Resources – 55%

New South Resources – 8.2%

QUOTED SHARES ON ISSUE (ASX: AGC)

269.28 million

MARKET CAP (at January 28, 2025)

A$78.09 million