Gorilla Gold Mines is making its mark on WA's Goldfields and its rapid exploration success bodes well for high-grade resource growth at its three previously mined assets.

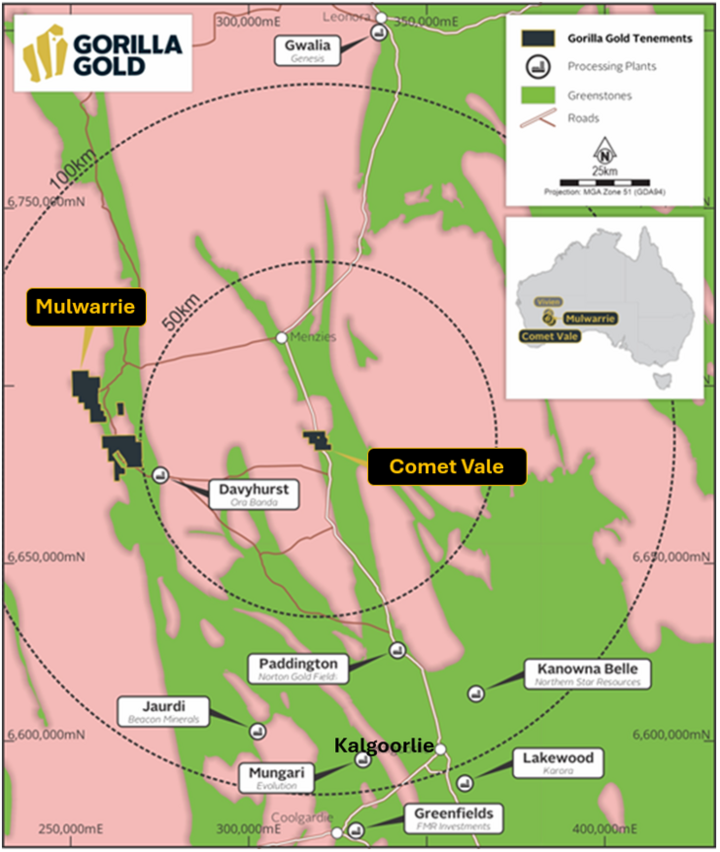

In the past year, Gorilla has consolidated ownership of three "forgotten" gold projects – Vivien, Mulwarrie and Comet Vale. All three sit on granted mining leases close to infrastructure but did not receive a full exploration focus from former owners.

Since taking the helm, CEO Charles Hughes has overseen the rapid growth of Gorilla's Australian resources to 730,000 ounces at 4g/t, with 630,000oz added so far this year alone through focused exploration.

He said the company's rapid growth trajectory reflected its significant long-term growth aspirations.

"We are rapidly delivering on a simple strategy that will create a high-grade gold developer in Western Australia with multiple execution options," he said.

"Our aim is to quickly establish the sort of resource base that could potentially justify the construction of a mill.

"However, the strategic location of our key projects close to multiple operating plants in the heart of the Goldfields builds another layer of optionality into the business."

The well-funded explorer has seen its share price double in 12 months and the company was recently included in the benchmark All Ordinaries index.

Hughes said creating so much value for shareholders in a short period of time – by building a company where people wanted to come and work every day, with a great work culture of getting things done, quickly and safely and well – was a real highlight.

"I'm so proud of the team we have built and the ethos we have created!" he said.

The company raised A$25 million in an institutional placement in March and Hughes put shareholder support down to two factors.

The first was having a strong board and management team that had "done all of this before, multiple times: found mines, financed mines, built mines and created shareholder value".

"Secondly, we are delivering on what we set out to do," he said.

Driving towards development

Hughes said the quality and scale of Comet Vale continued to surprise and the company saw genuine camp-scale potential emerging as it works towards a major resource update in the December quarter.

The historical focus at Comet Vale had been on the Sovereign deposit, that produced 200,000 ounces at 20g/t.

"We are really pushing this project forward, at pace," Hughes said.

"We've made multiple new discoveries at Comet Vale this year, thick high-grade gold from surface, and at the same time we have recognised significant further discovery potential at Comet Vale.

"We've identified a 10km by 3km corridor of major structural deformation and gold mineralisation and we are working towards unlocking this camp-scale potential with five drill rigs operating at Comet Vale."

Just 60km to the west, Gorilla boosted Mulwarrie's resource by 340% in August to 350,000oz at 3.6g/t and recently reported high-grade step-out results including 4.2m at 54g/t.

Hughes said Mulwarrie was a strategic asset and had good synergies with Comet Vale.

"We're looking to double the resource at Mulwarrie in the next 12 months through a drilling program that's scheduled to kick off later in 2025," he said.

To the north, the Vivien mine 15km west of Leinster had produced 260,000oz at 5.68g/t for Ramelius Resources and Gorilla recently announced a maiden resource of 278,000oz at 4.1g/t and pointed to further upside.

Drilling continues at Comet Vale and Hughes plans to get rigs back to Mulwarrie and hopefully Vivien in the coming months.

At the same time, Gorilla is driving permitting and studies forward at all three projects and Hughes is looking forward to continued resource growth.

"We continue to drive these great projects forward," he said.

ABOUT THIS COMPANY

Gorilla Gold Mines Ltd

Gorilla Gold: Western Australian Mining Exploration

Gorilla Gold (ASX: GG8) is a gold explorer based in Western Australia focused on the exploration upside of under-explored mining projects close to existing infrastructure. The strategy is underwritten by its current global JORC Resource of 675koz at 4.7g/t, providing a platform for further resource growth.

Gorilla Gold benefits from access to capital and expertise for accelerated exploration within Western Australia.

HEAD OFFICE:

- 292 Barker Road, Subiaco WA 6008

- Phone: +61 8 6149 1573

- Web: https://gorillagold8.com/

DIRECTORS:

- Dean Hely

- Simon Lawson

- Kelvin Flynn

- Alex Hewlett

- Charles Hughes

- Mark Rozlapa

SHARES ON ISSUE: 729.01 million

MARKET CAP (at December 16, 2025): $390.02 million