Catalyst Metals' now almost debt-free status has quickly started to pay dividends, with the small gold miner able to self-fund a restart of the existing Plutonic East underground.

The aim of the game is to get more ore into the existing but underutilised Plutonic mill in Western Australia's Plutonic/Marymia belt, boosting production and reducing costs.

While the company's longer-term focus is on starting a new mining hub up the road at Trident, managing director James Champion de Crespigny said as production had stabilised at the main Plutonic underground, and as Catalyst gained a better understanding of its assets, Plutonic East had emerged as a low-risk, low-cost option.

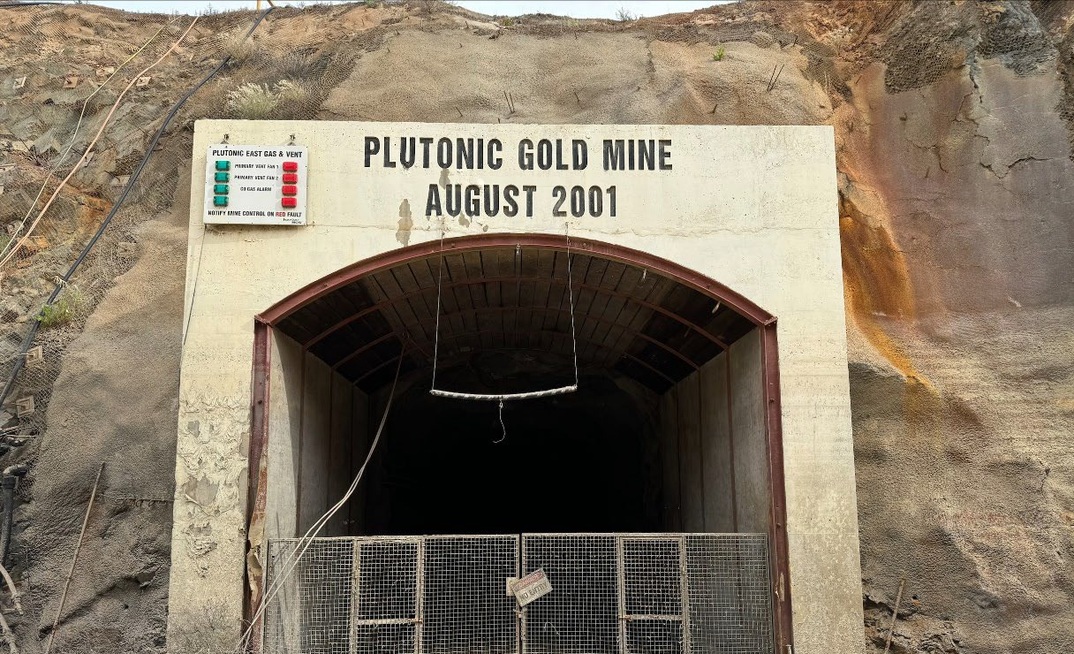

Dewatering of the 23-year-old decline started in April. Teams are expected to go down the decline over the coming months and start an initial 400m of rehabilitation work.

A platform will be established to support grade control drilling.

De Crespigny said the existing infrastructure appeared to be in good condition and was dewatering faster than expected.

Low-cost expansion

The company said it had become clear the costs would be substantially lower than its original estimates.

Catalyst has started rebuilding an additional jumbo to help with the work, and given the similarities with the existing workings it is confident Plutonic East has a low executional risk. It is also fully permitted, so there is no schedule risk.

First ore is expected early in 2025.

Plutonic East had a historical resource of 522,000oz grading 4.1 grams per tonne.

The mine is only 2km from an underutilised 1.8Mtpa processing plant and was developed by Barrick Gold in the early 2000s.

It was allowed to flood after being placed on care and maintenance in 2012. Barrick Gold recovered some 30,000ozpa at grades between 3-7.2gpt. Gold was trading at A$1500/oz when it closed.

Subsequent owners have never revisited the asset.

Higher-prices improve grade

Catalyst is re-estimating the resource and, based on its existing operations, believes grades from 2gpt should be profitable.

Work continues at Trident, some 25km along the belt, as a potential source of open-cut and underground ore.

Catalyst aims to boost production from around 110,000ozpa to around 200,000ozpa.

It hasn't released costs for the Plutonic East restart but is confident it can be funded from free cash flow.

Catalyst has some $22 million in cash and managed to pay down $28 million in debt over the past year.

Shares in the miner were up 1.4% to $1.09 this morning, valuing it at $245 million.

Argonaut's Hayden Bairstow has a speculative buy recommendation on Catalyst with a valuation of $1.50 per share.

"The addition of Plutonic East ore presents upside risk to our base case and takes the pressure off remnant mining volumes at Plutonic, which is currently CYL's only source of ore," Bairstow said.