John Anderson: Yes I felt the RIU Sydney conference this year was one of the best I have attended for investor support. The brokers and funds are very interested in good stories like Investigator’s at the moment. Our stream of positive news on Paris and Nankivel has maintained our share price against flat market interest in miners and explorers over the past three months. The number of long-term IVR investors who came up to our booth to give on-going support was very heartening.

GSIH: You have a significant, high-grade silver resource at Paris on South Australia’s southern Gawler Craton. You are also perhaps starting to change long-held views on the style of deposits to be found in a region that has yielded Olympic Dam, Carrapateena, Prominent Hill and others, with your Nankivel porphyry copper-gold targeting. What is the significance of what you’ve recently reported there, and what are your next steps at Nankivel?

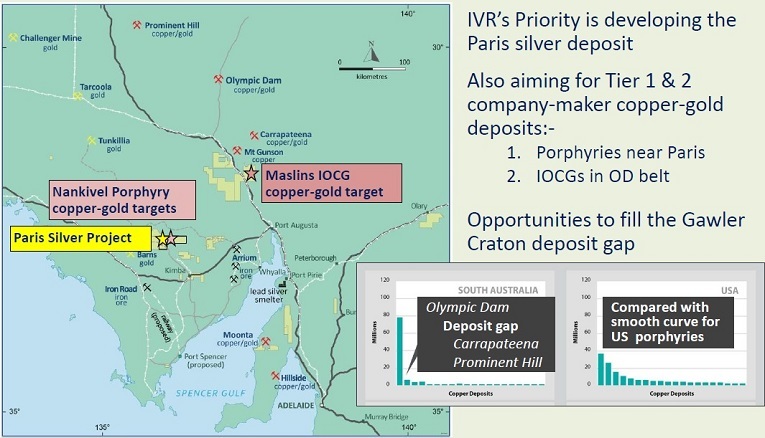

JA: Investigator is well positioned for an upturn in investor interest in a number of areas of the resources market. With our foundation Paris project getting larger and more advanced, the company has good exposure to the cyclic silver market which offers more frequent uplifts than most metals. With our focus on the emerging Paris-Nankivel field, along with nearby silver targets to build on Paris, we also offer the diversity of gold and copper potential as better understood metals in the Australian investment scene. I believe Investigator’s concept of porphyry copper-gold deposits having formed at the same time as Olympic Dam is firming progressively each time we drill. It is giving Investigator first-mover advantages of filling the widely discussed deposit gap between Olympic Dam and the smaller IOCG deposits in the Gawler Craton.

GSIH: Is the typical depth of porphyry systems, and hence cost to ramp up exploration, a problem given the need for you to focus on moving Paris forward quickly?

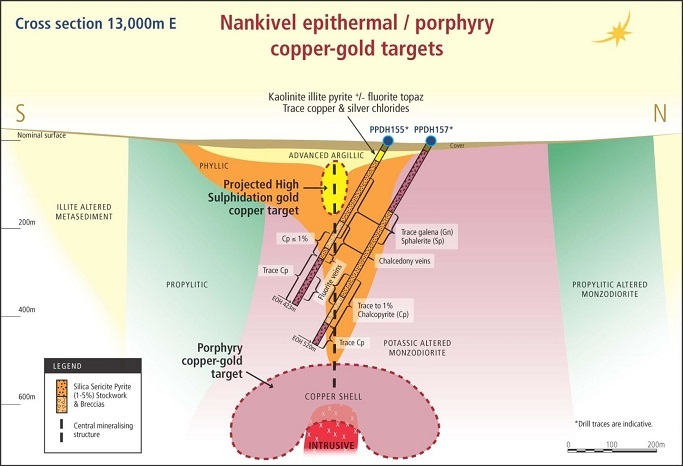

JA: No, not at all. The multiple intrusive and mineralising phases now recognised actually offer two new opportunities to IVR. The first one is the beefed up potential for further shallow epithermal deposits that we will explore ourselves down to 150m below the surface as open-pittable add-ons to the Paris silver project. The second is the breakthrough concept of underlying porphyry copper gold deposits. This is a major new opportunity that will require considerable funding, whether deep or shallow targets. So we are seeking a JV partner with deeper pockets to fund that aspect of the Paris-Nankivel field. The Paris and other epithermal targets are considered to be the top of the youngest mineralising phase. As such the proposed porphyry targets will start about 600m below the surface. Shallower porphyry targets are expected closer to the present surface for earlier mineralising phases. As first-comers to a new field for a new deposit style in a pedigree belt, we are looking forward to some positive surprises as we aim to continue to make the first round of discoveries initiated by the Paris silver deposit.

GSIH: What do you see is needed to generate stronger investor interest and recognition – including possibly joint venture interest and funding – specifically in Nankivel?

JA: We have set the train in motion to upgrade the standing of our Paris-Nankivel projects. One, advanced metallurgical testing of the robust Paris silver resource to build on the positive results of the preliminary metallurgical testing. Two, drilling of the new shallow Nankivel epithermal gold-silver-copper target. And, three, seeking a joint venture partner for the porphyry copper-gold exploration centred on Nankivel but applicable to a 50 square kilometre area.

GSIH: Where does Paris rate now among undeveloped silver deposits in Australia, and what are aiming to get done there in the next 3-6 months?

JA: Investigator believes Paris is the best undeveloped silver project in Australia due to its strong combination of silver grade and contained silver ounces. Paris’s grade of 139g/t silver, at a relatively high lower cut-off of 50g/t, is significantly higher than peer silver deposits that are also likely to be open-pittable. It is timely to undertake a new and larger round of metallurgical testing, having raised the contained ounces by another 26% to 42 million ounces of which 55% are converted to Indicated in the latest resource estimation. Five tonnes of sample were collected from the 2016 infill drilling and preserved for metallurgical testing. Studies are being completed to further characterise the ore types, so the laboratory testing will commence soon. A water source is also another important consideration, so drilling of the palaeochannel discovered by Investigator 12km east of Paris will also commence soon as the basis of a hydrological study.

GSIH: We note the circa-A$800,000 R&D tax refund you have received, related to work done on Paris. How important those funds to you at this stage/what current bank balance?

JA: The R&D tax concession was derived from research in developing the hypotheses at Paris, Nankivel and Maslins, all inter-related as flow-on ideas and are potentially important breakthroughs for South Australia’s research and discovery space. The refund is very important to Investigator both as an endorsement of our innovative research-based approach, as well as bolstering our funds by re-investment into our approach and ideas. Investigator is punching above its weight in exploration and research, so we appreciate the support.

GSIH: Why is the discovery of a new deposit type/wider recognition of this important from a South Australia perspective?

JA: Investigator is focussing its exploration on South Australia as the state offers the challenges and opportunities of both cover and old geological ideas that are respectively being penetrated and challenged with the resulting rejuvenation of its discovery potential – that is, where and how to look for new deposits and metal commodities. Investigator’s concepts have already added epithermal silver as a new substantial style for that commodity to the state. The flow-on idea of porphyry copper gold will add a new style, although well-established overseas as the main source of copper, was unexpected by accepted dogma as a potential new dimension to the exploration space in the Gawler Craton.

GSIH: You’ve got a new geophysics program planned, and more drilling to come. You’ve said you’ve got a number of good targets presenting. What are the highest priorities/why?

JA: We have five new or revitalised shallow epithermal targets prioritised for testing. Drilling of the Nankivel epithermal target is underway with sufficient outcrop and geophysical work already delineating the target. An extensive expansion to the 2016 induced polarisation (IP) geophysical survey is planned to better define the other four epithermal targets at Nankivel West, Helen, Argos and Alexander. As the same IP survey will underpin the exploration for underlying porphyry targets, it will be held-over until we secure a JV partner for the deeper targets.

GSIH: What do you expect/hope to have achieved by June 30, all going well?

JA: To have the Paris silver project advancing towards pre-feasibilty study in the September quarter, the Nankivel gold-silver epithermal target positively drill tested, a prospective joint venture partner for the copper gold porphyry exploration at Paris-Nankivel, and drill access permitted at Maslins to enable funding to be sought for drilling of that new generation of IOCG target.