Saturn recently upgraded the resource under an improved bulk mining, heap leach processing scenario.

A preliminary economic assessment was imminent - "which we are feeling positive about" - and the company is planning a bulk sample and pilot heap leach project in 2024-2025, which could generate cash and optimise full-scale development and capital plans.

Apollo Hill sits within Saturn's under-explored 1,000 square kilometre land package near Leonora in Western Australia's Goldfields.

The company's consistent, systematic approach to advancing Apollo Hill is evident in the five resource upgrades in as many years since listing on the ASX.

The resource has increased significantly from the initial 505,000oz and it remains open along strike.

"As our geological understanding of the deposit continues to grow, so does its potential for growth," Bamborough said.

The latest update takes Apollo Hill's resource to 105 million tonnes at 0.54g/t gold for 1.84 million ounces.

Bamborough said the upgrade was driven by factors including an improvement in metallurgical work, geotechnical parameters and additional drilling.

"We've approached this particular resource model with a much bigger selective mining unit, which is actually capturing the upside in the deposit in terms of its bulk mining potential," he said.

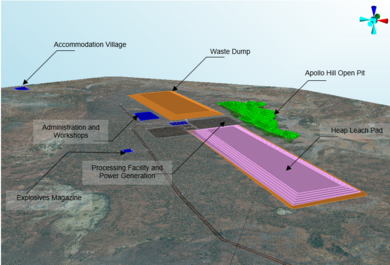

The proposed site layout at Apollo Hill

"A bigger selected mining unit and bigger mining benches means bigger equipment, so economies of scale kick in and we've ended up with a much-improved resource."

Meanwhile grade control studies on three different areas at Apollo Hill not only confirmed the integrity of the resource but also returned shallow higher grades, including 10m at 10.4g/t from 6m within 55m at 2.12g/t gold from surface.

Standout features

"One of the hallmarks of Apollo Hill is its very simple, clean and consistent metallurgy - unusually so - which allows us to consider a much lower cost processing route," Bamborough said.

The resource lends itself to very low 1.5:1 strip ratio and is constrained within a single, simple, large pit shell.

"And as of yet, it's untapped," Bamborough said.

"Rather than multiple ore sources in largely historic fields, there are a lot of new ounces all in one place."

Pilot aiming for positive outcomes

Saturn's heap leach processing plans could propel Apollo Hill towards a peer group that includes gold major Kinross Gold at its Round Mountain and Bald Mountain gold mines in Nevada, US.

Apollo Hill's planned bulk sampling and heap leach pilot project is to be done at scale.

"The planned bulk sample pit itself is no small undertaking," Bamborough said.

"We expect it to be 200-300m long.

"The target is to stack 1Mt-plus on the heap leach pad.

"The pilot operation will give us the ability to demonstrate what is possible from a deposit perspective, and a market, social, financial and environmental perspective.

"It'll be great to be able to demonstrate that to shareholders … and all those things will populate our feasibility studies moving forward."

The company expects to run the pilot heap leach operation and associated bulk sample pit contiguously with a definitive feasibility study.

Construction for the pilot operation is planned for the first half of 2024, subject to approvals and a final investment decision.

Bamborough likened the pilot project to "doing a study in real life" and said positive outcomes would help pave the path to production.

"Good financial outcomes could also translate to a much better capital journey for Apollo Hill's development," he said.

The project's progress neatly coincides with a strong gold price environment which has seen the precious metal price up near US$2,000 an ounce.

Bamborough said Saturn had done its homework on local costs, thanks to a heap leach gold project commissioned near Kalgoorlie last year, and believed Apollo Hill would compare favourably to global peers on many aspects.

"We're confident in the picture we're putting forward," he said.

"We've put a fair bit of thought into the scheduling of both the mine and the capital cost structure so I think we're very happy with the way the studies are coming together."

‘Running our own race'

Saturn Metals' heap leach plans also set the company apart in the more mill-focused district that's seen plenty of consolidation activity, including Genesis Minerals' recent acquisition of St Barbara's Leonora assets.

"We're running our own race," Bamborough said.

Saturn Metals MD Ian Bamborough

"Apollo Hill has got some inherent strengths, and we're using those inherent strengths to make the deposit work in its own right.

"We really want to see it come out of the ground in an optimal way for our shareholders.

"Perhaps we do sit outside some of the mill-based strategies in the region but I believe that's an optimal approach for this particular deposit, for its development.

"Beyond that, we have a great belief in our land package and exploration process and we are only just beginning to do justice to that potential."

Regional exploration heats up

Having barely scratched the surface at the broader Apollo Hill project, Bamborough continues to think of Saturn Metals "as an exploration company with a great development asset".

A three-pronged regional exploration program is underway, following aircore results reported in March from new terrain, 10km from Apollo Hill, which included 8m at 3.37g/t within 20m at 1.44g/t from 88m.

The company was awaiting aircore results at the time of going to press from regional drilling on the southern half of its tenement package, along the Keith Kilkenny corridor.

Reverse circulation drilling was ongoing at some of the more advanced regional prospects.

"There are some tantalising results and we're out RC drilling, trying to put the puzzle together," Bamborough said.

Thirdly, the company was preparing to push into the new frontier of its completely unexplored salt lakes.

"I think they will give a whole new dimension to the regional exploration program," he said.

Elsewhere, Saturn has an exploration package in New South Wales' Lachlan Fold Belt but its core focus is on advancing Apollo Hill.

Strong support for systematic approach

The company has the funds to achieve near-term milestones at Apollo Hill thanks to a recent capital raise, supported by Australian and overseas institutional investors, plus major shareholders including Dundee Corporation which increased its stake to 19.99%.

Bamborough believes shareholders appreciate Saturn's "no stone left unturned" approach.

"I think we represent great value on an EV [enterprise value] per resource ounce basis," he said.

"Especially when you consider the quality of work we have put into our assets."

He said there was real depth to the work being undertaken as Saturn advanced on three fronts at Apollo Hill.

"Our big project is coming along nicely, which our PEA should demonstrate," he said.

"Then there's the exploration story and the ground package which we don't let up on.

"And thirdly is this quite exciting pilot project where we can demonstrate the capacity of the whole system."

ABOUT THIS COMPANY

Saturn Metals

HEAD OFFICE:

- 9 Havelock Street, West Perth WA 6005

- Phone: +61(0)8 6234 1114

- Email: info@saturnmetals.com.au

- Web: www.saturnmetals.com.au

SOCIAL MEDIA:

DIRECTORS:

- Ian Bamborough

- Brett Lambert

- Andrew Venn

- Rob Tyson

- Adrian Goldstone

QUOTED SHARES ON ISSUE:

- 161 million

MARKET CAP:

- A$27 million (at July 18, 2023)

MAJOR SHAREHOLDERS:

- Dundee Corporation – 19.99%

- Franklin Templeton – 9.99%

- Wythenshawe Pty Ltd and Associates – 10.17%