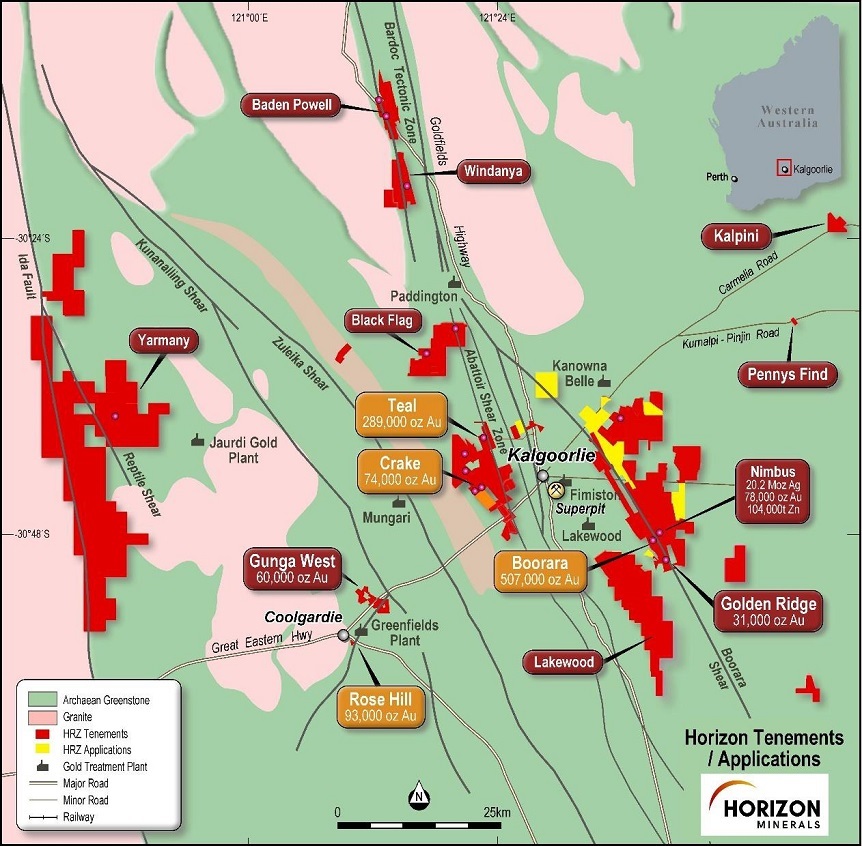

Horizon, with its massive landholding in the goldfields hub, has been in the news spotlight lately.

It decided last month to advance development work on the high-grade, 100%-owned Nimbus silver-zinc project next to its Boorara gold mine, just east of Kalgoorlie.

Completion of a successful six-month Boorara toll milling campaign has swelled cash receipts and produced valuable mining and processing data to be fed into Horizon's definitive feasibility study on a one million tonnes per annum/50,000-60,000ozpa gold operation at Boorara. The company continues to have sights set on a standalone operation being in production next year.

And Horizon has continued to report solid results from a big resource drilling effort at five sites within 50km of the proposed plant. It expects to update its global resource of about 1.1 million ounces in the June quarter, including a maiden ore reserve for Boorara and mining inventory for at least five years to underpin the DFS.

This year's A$5 million, 50,000m drilling campaign includes about 30,000m of "discovery drilling" at a bank of quality targets on Horizon's circa-890sq.km of ground around Kalgoorlie.

"With developments at Nimbus and results from the drilling we've done at the four satellite projects within trucking distance of Boorara, and of course Boorara itself, the market is going to be hit with an enormous amount of newsflow, week on week, in the upcoming period," Price says.

"The reserve conversion work we've virtually completed - 20,000m of drilling - has 70% of the assays still in the lab; they're coming slowly [due to current heavy demand and labour shortages].

"But what is more exciting for me is now we're really turning our attention to new discovery, and new resource drilling, and that's what the 50,000m this year is all about.

"There's at least 15 targets we've identified for the new discovery drilling. Finally we're able to go out on our property - 890sq.km of it - and actually do it justice. We've spent a lot of time doing the geophysics, the geochem, and the target-generation work, and now the drill rigs are on deck and drilling away."

Horizon has four rigs turning and there could be more depending on results.

High-priority "new discovery targets" have been defined at what are described as greenfields project areas including Windanya, Lakewood, Yarmany, Binduli, Kanowna South and Balagundi.

"I'm really excited about a project called Kanowna South, which has got a huge aeromagnetic anomaly that says, please drill me. So that's exactly what we'll be doing," Price says.

"The whole land package runs adjacent to the [Kalgoorlie] Super Pit, but it runs on a trend through the Boorara shear up through the Kanowna Belle [gold mine] area. There are some enormous anomalies there that have had drilling down to about 90-100m, and we want to go under that and have a good look at what's going on.

"We're going to be testing the 25km of strike from Kanowna in the north down to Golden Ridge in the south, and really looking for new things as well as extensions north and south of Boorara proper. Boorara itself has 1.5km of strike with possible extensions.

"So that Boorara complex is really interesting.

"Over at Lakewood [south-west of Boorara], immediately south of the Super Pit, there has been a reasonable amount of previous work done, but again shallow and in this case relatively difficult on-lake drilling. We're going to be putting a fair bit of work into aircore through that area and looking to understand what sits below the sediments in that Lakewood region.

"Yarmany is a massive landholding on the Ida shear [west of Kalgoorlie]. That's hardly been touched. We've had prospectors out there finding lots of gold and we've got targets ready to drill. So we will be drilling them this year.

"And we've had some fantastic drill numbers that we need to follow up at places like Windanya and Baden Powell as well [north of Kalgoorlie].

"So it's all pretty exciting and having to prioritise was a difficult task.

"But with the reserve drilling now behind us we will have up to four rigs - an aircore, two RC and a diamond rig - systematically rolling along through the program we've mapped out. We get the results and then go back and infill based on what those results tell us.

"We aim to go and find something new and something substantial and do our ground justice from organic growth rather than any more major acquisitions."

Horizon entered 2021 with more than A$15 million of cash and investments and remains well funded for its big Kalgoorlie drilling program and project study work.

Price, the former general manager of the St Ives (Kambalda) and Paddington (Kalgoorlie) gold mines, and founding managing director of Phoenix Gold, says the company assessed a range of options for 100%-owned Nimbus and decided "there is a lot more value in it for us to go and have a crack at it - so that's the plan".

"Our view is that silver prices are going to hold, if not get better," he says.

"Nimbus has been a silver mine and produced before, and the high-grade underground stuff is what we're having a really good look at. The work we've done suggests the primary material has less of the nasties [including mercury, antimony and cadmium] that were in the oxide and transitional and the grade is really good. We've got lodes sitting at 900-1000gpt silver and 19-20% zinc, so hopefully we can turn that into money.

"It really comes down to market sounding of offtake for a high-grade precious metal concentrate, so that's what we're doing.

"The previous DFS was essentially completed without the economic analysis in 2017. So a vast amount of drilling and geology work, and process flowsheet design, was done. We've got to dust that off and have a good look at it technically, again, and update the capex and opex costs."