The experienced zinc miner has successfully worked with its joint venture partners to unveil an updated, robust definitive feasibility study for its 65%-owned Tala Hamza project in Algeria, described as one of the largest undeveloped zinc and lead mines in the world.

The updated DFS has taken on board feedback from the government-owned joint venture partners, ENOF (32.5%) and ORGM (2.5%), who were uncomfortable with the original proposal of block cave mining.

The study released this week outlines a 21-year mine life, producing an average annual 129,300 tonnes of zinc concentrate and 26,000t of lead concentrate, using the underhand drift and fill mining method, resulting in less surface infrastructure and a substantially reduced capex of US$341 million.

The base case scenario points to a strong financial return with a post-tax nominal NPV (at an 8% discount) of $303 million and an internal rate of return of 14%.

CEO Richard Taylor said it had been a long journey for Terramin to work with its Algerian stakeholders to understand and deliver what would be acceptable in the north African country.

"We've got a very positive relationship with them based on that change and I think things are different now," he told MNN.

"We've done our homework, we've worked with the people on the ground and we've got support building for the project - not only with the central authorities but also with the local Wilaya community that we rely on in that area.

"I think we've got a very long-life mine that has a strong economic case for development behind it.

Terramin CEO Richard Taylor

"And I think that this project will benefit from the upside case in price that will happen early next decade and potentially for longer.

"It's a pretty exciting time for us as a company and it's been a long time coming."

Taylor took on the role in May, bringing experience from companies including Oxiana that had moved from exploration into production.

"I know how hard it is to get there but you've got to lay the foundations now for the type of company you want to be in three to five years," he explained.

"I've got a strong vision about where I want the company to be and I want to get there as soon as I possibly can.

"Our vision for Terramin is to be a leading base metals company with a geographically diversified group of projects - I come out of three companies that have made that transition and I think it's well achievable with the assets we've got."

In the base metals space, Terramin put its Angas zinc mine in South Australia on care and maintenance in 2013 when metal prices dropped.

The project has an existing 1.2 million tonne resource and the company could potentially reopen it - plus it is examining the feasibility of using the Angas plant to treat high-grade ore from its Bird-in-Hand gold project 35km to the north.

The Angas processing facility

Bird-in-Hand's resource comprises 588,000t at 13.3g/t gold for 252,000 ounces which would rank it among the highest-grade gold mines in Australia.

The project's stand-alone potential has prompted Terramin to assess a demerger of its gold assets, with a view to making a decision in early 2019, and it is working to prove up the assets as quickly as possible.

"Zinc and gold are not common bedfellows in companies of this size," Taylor noted.

"We're looking at the quality of the assets in South Australia and the potential of them - if they were in a separate entity, they could be a significant gold producer in their own right.

"We're looking at how we can better match our investor requirements between those who like our zinc story in Algeria and those who like gold."

Terramin has set itself an aspirational target to define a 1Moz gold resource at its South Australian tenements, which span about 12,000km2 from near BHP's Olympic Dam in the state's centre to the historic mining district east of Adelaide.

Taylor said the vast landholding held the potential for a variety of commodities including copper.

"We're really keen on being able to narrow that down to those that are prospective for gold and target those over the next two years and farm out part of those projects that are deemed non-core," he said.

Elsewhere, the company has already formed a joint venture over its non-core Kapunda copper in-situ leach project, which contains a 47.4Mt resource at 0.25% copper, and its partners this week announced successful test work from core samples yielding copper recoveries of up to 78%.

Environmental Copper Recovery is earning up to 75% of Kapunda and Thor Mining is earning up to 60% of ECR.

"We're very focused on our gold strategy that we have in place but we're watching with interest what's happening with Kapunda," Taylor said.

The company recently gained further financial support from majority shareholder Asipac Group, which is enabling it to execute its corporate strategy while reviewing long-term financing as its projects gain pace.

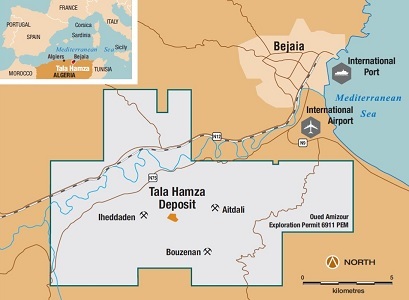

Returning to Tala Hamza, Terramin is keen to build on the momentum in Algeria for the fortuitously positioned project.

Tala Hamza has good access to infrastructure

It lies 15km from a deep water port, 10km from an international airport and has access to water, grid power and an educated workforce.

The exploration licence expired in January and the company is aiming to replace it with a mining licence.

"I was in Algeria just under 10 days ago and we've got very good relationships with our stakeholders, our JV partners and the government and we're working with them to put forward the mining licence," Taylor said.

"We don't have any more exploration work that's required for the mining lease application and extension of the exploration licence is not appropriate given those requirements, so we're expecting to continue to work positively and be able to resolve the application and proceed to development in the foreseeable future.

"The approach we've got now for Tala Hamza is right, it minimises the surface expression of the project and contains it within an area that is supported by the local government and local community.

"Most people in the market are seeing that there's a deficit in new projects coming forward and Tala Hamza is one of those projects that people see as being a probable project in the future, at a time when supply is going to come under pressure in the next decade.

"The momentum we've got behind us at the moment I think is very positive and we should be able to get out more information to the market and have a good story to tell over the next few months and hopefully that will flow through to share price results in the near-term."