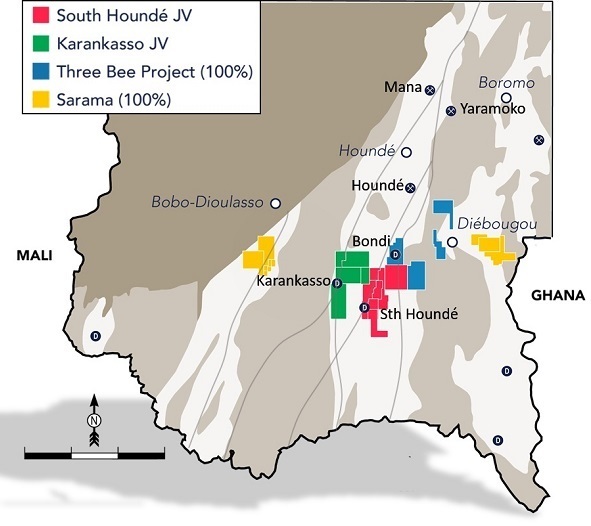

The Sarama co-founder says the recent transfer of the Djarkadougou property - which hosts the high-grade Bondi deposit - into the company’s wider ThreeBee project area was more momentous than it looked on the surface. The transfer concluded a protracted transaction with key Sarama shareholder and established Burkina gold producer Orezone.

With 2.1 million ounces in resources at the central, 50%-owned South Houndé property being explored by Acacia Mining via a US$14 milion earn-in agreement, and more ounces in satellite ground around the hub, Sarama has been looking for both prime exploration ground on a belt that’s already yielded three significant mines, and key pieces in a shifting future production picture.

Structuring of its deals has ensured Sarama – capitalised at only C$21 million this week – retains a big say in the way any development scenario unfolds.

While it’s been a testing year for Acacia with the geopolitical upheaval in Tanzania, and Sarama has flown under the investment radar with its patient manoeuvring in southern Burkina Faso, there is no doubt the regional picture is evolving positively while Acacia continues to fulfil its joint venture obligations at South Houndé with intelligent exploration spending of US$3.5 million a year.

This year’s drilling to better define depth and overall project potential has confirmed the continuity of high-grade zones at depth on the MM and MC deposits, while air core drilling in the Phantom East area has also intersected excellent grades in oxide material (including 10m at 7.15g/t and 12m of 5.78g/t). The partners will soon release their first resource update for 18 months and provide more detail on the underground development potential.

Acacia is down for US$3.5 million more of exploration spending in 2018 and Sarama continues to be free-carried while Acacia earns up to 70% of the property, which already has a resource capable of supporting a low-cost 60,000ozpa heap leach gold operation.

Schmiede says Bondi, off the northern border of the South Houndé project, has an historical resource on it but has not been the focus of serious exploration for some time while, for example, Teranga Gold has been reporting significant drill results from Golden Hill project further north. In fact, the measured, indicated and inferred ounces at Bondi would add significant, high-margin inventory to any production at South Houndé, or even the Karankasso joint venture with Savary Gold for that matter (671,000oz inferred).

But, one way or another, Sarama sees considerable upside to the 430,000oz base at Bondi, where the existing resource remains open in several directions and other targets have been generated.

“Bondi is a highly strategic asset to acquire in that region and we were chasing it for a long time,” Schmiede says.

“I think it’s a good exploration property and has a good starting deposit there, as a minimum, but in terms of strategic value it really gives us the ability to influence development in the region more broadly.

“That property can go north to Teranga’s Golden Hill project, where it is putting about US$4 million into exploration this year, it can go south to complement the South Houndé project, and it could even get added to the Karankasso project, in terms of creating that critical mass for a development.

“Now the transaction is closed we can go forth and conduct decent exploration. The property hasn’t really been touched for a long time within Orezone. There has been a lot of historical spend in and around the resource area – that’s been very well drilled.

“But we will look to the broader property area to recommence brownfields exploration.”

Sarama has some results from a small aircore drilling program it was allowed to complete at Bondi earlier this year.

Schmiede said the start of ground-truthing of available project data was part of a process aimed at prioritising targets for follow-up drilling, and “we’re quite excited about being able to go back and do that stuff”.

Bondi makes four ‘Bs’ at Sarama’s ThreeBee project – also featuring Bamako, Bouni and Botoro – which are all proximal to Teranga’s new discoveries and have had promising preliminary work done on them.

“I think the pulling together of those has been significant,” Schmiede says.

“It gives us a 100%-owned project focus to complement the interests we have in those other projects.

Sarama has about C$1.9 million in the bank after a recent placement for exploration to complement the circa-US$5.5 million a year being spent by others on JV ground, where it will make a $700,000 contribution over the next 12 months.

“We’ve got interests in 3.2Moz in a well-endowed belt that we think is under-explored, in probably one of the best mining jurisdictions in Africa.

“Burkina has been a standout in terms of new mines started in recent years, with most of that the result of a surge in exploration activity after the mining code was changed in the early 2000s. That exploration spending dried up in the downturn, and is now picking up again.

“The scarcity value of available, advanced exploration properties is rising, and we’re sitting on 1.7Moz attributable and big tracts of prospective ground. And we effectively have the control premium in and around South Houndé.

“We’re seeing certain [West Africa] stories on the ASX and TSX that pique the interest of investors carrying pretty hefty valuations on them on a dollar-per-ounce basis.

“We’re trading at about US$10/oz and probably should be at least $30/oz.

“And that’s before we get to projects in our portfolio that aren’t necessarily marketable right now, and our strategic position and influence.”

Sarama Resources – at a glance

HEAD OFFICE: Suite 8, 245 Churchill Ave, Subiaco WA 6008, Australia

Telephone: +61 8 9363 7600

Email: info@saramaresources.com

Web: www.saramaresources.com

DIRECTORS: Sean Harvey, Andrew Dinning, Simon Jackson, Dave Groves

QUOTED SHARES ON ISSUE: 139.9 million

MARKET CAP (at September 1, 2017): A$22 million

MAJOR SHAREHOLDERS: Management (20%), Sun Valley Gold (15%), Orezone (8%), Gold 2000 (7%)