The junior is shaping up to be one of the state’s next gold producers as it slots together two halves of a golden puzzle, with its option to buy the Indee gold project that adjoins its flagship Turner River gold project.

De Grey’s heart is in building the gold assets and getting into production as soon as possible. However, there remains plenty of upside in its budding base metal and lithium prospectivity.

On the gold front, the 100% owned Turner River’s total resource is fast approaching 500,000oz after the resource at its Mount Berghaus deposit more than trebled in January, 11 months since De Grey resumed management of the project.

The neighbouring Indee gold project and former mine site consists of six granted mining leases and some exploration licences. Apart from the mining leases it provides value to De Grey as it has associated infrastructure, a JORC 2004 resource of 345,000oz and a veritable cash cow of 850,000 tonnes of unprocessed heap leach ore sitting on surface.

It also has significant and previously unreported drill hole data undertaken by its current Chinese owners, Northwest Nonferrous Australia Mining.

De Grey has recently reported most of that data and presented the most significant intersections as follows: 16m at 4.50g/t from 72m, 12m at 10.82g/t from 64m and 22m at 3.46g/t from 110m, all from Withnell; 12m at 28.48g/t from 75m,10.5m at 10.8g/t from 84m and 11m at 6.87g/t from 149m, at Camel 1; and 9.0m at 4.49g/t from 79m at Roe.

De Grey is reassessing volumes of data, including the above results, as part of upgrading the Indee resources to JORC 2012, and is also commencing a scoping study to determine the potential scale of the mining development.

Following this, De Grey plans to quickly move onto a detailed feasibility study. This study allows De Grey to de-risk the final acquisition of Indee in 18 months for A$15 (US$11.5) million.

“The potential scale of this operation will place us within reach of a small and select group of ASX-listed gold developers,” De Grey chairman Simon Lill (pictured) explains.

“The combined projects currently give us close to a 1 million ounce resource base, with a significant portion already measured and indicated – and we see plenty of room for organic growth.

“This takes us from being an explorer to a company with basically a 1Moz development project, somewhat comparable to Capricorn Metals (AU:CMM) and Gascoyne Resources (AU:GCY), whom we hope to emulate.”

This month, Gascoyne raised A$55 million towards its 1.1 million ounce Dalgaranga gold project and has a market capitalisation circa A$166 million; while Capricorn secured A$10 million towards developing its Karlawinda gold project, which contains a 25.5 million tonne inferred resource at 1.1g/t gold for 914,000 ounces.

“Comparisons are rarely apples to apples,” Lill said.

“However, Capricorn has a market cap of about A$50 million versus our sub-$10 million. We are fortunate that our grade is higher with much of our resource base already defined to measured and indicated.

“We believe De Grey’s market upside is significant based on these comparisons alone.”

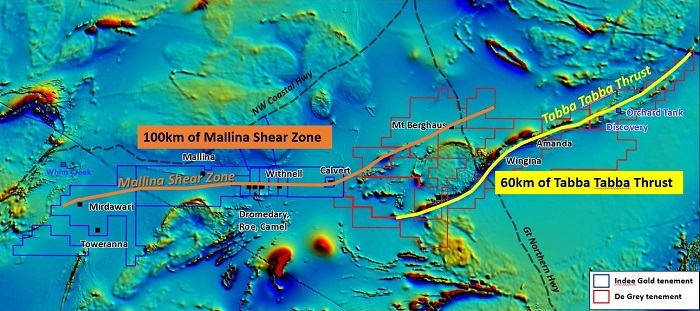

Geographically, the scale of the combined Indee and Turner River projects spans two major gold-hosting shear zones over 160km (pictured below), roughly the distance between Kalgoorlie and Leonora in WA’s Goldfields.

Gold-wise, De Grey believes its “forgotten” pocket of WA – just 50km from the mining services hub of Port Hedland – has the potential to host up to 2 million ounces.

“We expect to have 1 million ounces defined in the next six months and can see no reason why we won’t reach 2Moz and more in the future as we have over 160km of highly prospective shear zones,” geology manager Andy Beckwith said.

As noted much of the recent exploration drilling at Indee has not been publicly reported as it was completed by the Chinese private company.

There is a substantial amount of drilling beneath the existing deposits and a new target at Mallina where highlights include 4m at 9.11g/t gold from 4m, and 29m at 1.7g/t gold from surface.

Beckwith puts Mallina’s exploration target between 53,000-125,000oz and notes that there is plenty of other exploration and extensional targets to test on both the Turner River and Indee projects.

“The plethora of data we’ve obtained through Indee includes the above drill results as well as grade control, metallurgical testwork, geotechnical information, hydrogeological and other information suitable for feasibility studies,” he said.

“We just need to fill in some gaps.”

He was quick to remove any doubts about the Indee project, which was developed as a low capex heap leach project in a low gold price environment and was last mined in 2007. The heap leach project closed due to the combination of rising operating costs as the Pilbara iron ore-led mining boom took hold and flooding associated with Cyclone George.

“The project is technically robust and the gold price is now nearly three times what is was back then,” Beckwith notes.

“Also, metallurgical testwork indicates that the proposed CIL processing will produce better recoveries at Indee, of up to 96% in the oxide zones. That is also the preferred processing method for our Turner River deposits.”

De Grey is about to commence a scoping study to assess mining the shallow resources in a series of open pits and processing the ore through a centralised CIL plant at Indee, where some mining infrastructure remains.

Further, at Indee there is 851,000 tonnes of stockpiled heap leach ore sitting on surface (pictured, left). Initial sampling conducted by De Grey shows it may average 1g/t.

“I’ve taken 20-odd samples from surface and they average 1g/t gold, so that could equate to about 27,000oz at surface that just requires processing with no mining costs and could pay in full for the Indee acquisition,” Beckwith said.

“That stockpile means we have ore ready to go and we could use it to commission and commence production, or it could be a fall-back position in a big wet if we have any temporary mining delays.

“In our minds, this pays for the project without any risk of mining costs.

“We’re well-positioned to get stage 1 started, processing through a CIL plant located at Indee on the granted mining leases then truck from satellite pits.”

A high-grade starting point from a satellite pit could be the Wingina Well resource at Turner River with 288,000oz of contained gold. Wingina provides staged mining optionality as it hosts a high-grade lode of 1.1 million tonnes grading 4.1g/t gold for 144,000oz from surface.

Turner River’s total resource currently comprises 9.7 million tonnes at 1.5g/t for 464,000oz but Beckwith and experienced exploration manager Phil Tornatora believe the region has much more to offer, as evidenced by the recent resource upgrade at Mount Berghaus.

“The more we drill, the more gold we discover, so we are very confident further drilling will expand this resource,” Beckwith said.

As near-term priorities, the company is re-assessing Indee’s (pictured above) resource, conducting a scoping study on the combined Turner River and Indee projects, and then will tackle resource and extensional drilling at Mallina and Mount Berghaus, as well as considering numerous exploration targets as it swiftly moves to de-risk the proposed combination.

Turning briefly to the company’s lithium upside, Beckwith points out Turner River is within 40km of Pilbara Minerals’ world-class Pilgangoora lithium-tantalum project which is aiming for commissioning at the end of this year.

“Just south of our Discovery gold deposit, we’ve got the newly-discovered 7km King Col pegmatite anomaly, and defined three lithium-enriched zones with our latest infill soil sampling programme,” he said.

“The sky’s the limit there – one right drill hole and the world will turn.

“We’re in the right lithium country, a large lithium bearing pegmatite soon to be drill tested and we haven’t even looked into the pegmatite possibility on the Indee side.”

For now De Grey is focused on its golden future and Beckwith said the company planned to be “a long way down the track” towards de-risking its gold projects within the year.

“It’s pretty clear our share price should start pushing up towards the likes of Capricorn and Gascoyne as we do the economic investigations,” Beckwith said.

“Gascoyne and Capricorn are enjoying market success with both having done the work to get to where they are – we are fortunate that our resource base contains a significant quantity of measured and indicated resources, so our shareholders would like to see us follow their path.

“We are increasing the resources and doing the economic work now, and we think we may be there within 12 months.”

Lill said Indee added to De Grey’s credibility and propelled the company from being “a relatively forgotten and unloved explorer into a serious near-term developer”.

“We think we have a classic situation of one plus one equalling three – and maybe even four,” Lill said.

“We have an exciting year ahead of us with plenty of upside.”

De Grey Mining – at a glance

HEAD OFFICE: Level 2, Suite 9, 389 Oxford St, Mt Hawthorn WA 6016 Ph: +61 8 9381 4108 Fax: +61 8 9381 6761 Email: admin@degreymining.com.au DIRECTORS: Simon Lill, Davide Bosio, Steve Morris. TECHNICAL MANAGEMENT: Andy Beckwith, Phil Tornatora COMPANY SECRETARY/CFO: Craig Nelmes QUOTED SHARES ON ISSUE: 173.3 million MAJOR SHAREHOLDERS: Directors and Management 6%; Top twenty 24%

|