St Barbara is moving beyond its turnaround into a gold mining success story and is in prime position for its next chapter of growth.

The company notched up record annual gold production at its two gold mines during the 2015/16 financial year, at Gwalia in Western Australia’s Goldfields and Simberi in Papua New Guinea. Simberi achieved its annual target of 100,000 ounces a month before the end of the year.

As managing director and CEO Bob Vassie explains, St Barbara is now an ASX200 listed company and ready to begin its next phase of considered growth.

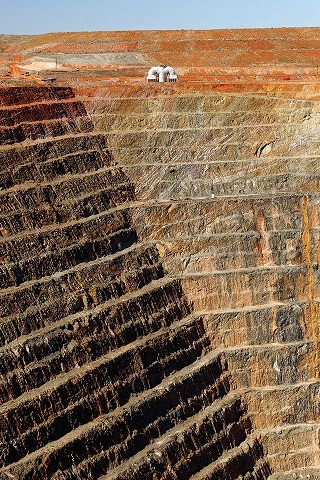

At the time of going to press, St Barbara was reviewing its Simberi operations and examining expansion options at Gwalia to take one of the world’s deepest trucking mines deeper still.

“We’ve got record production at both our operations, a record share price at the moment, record financial performance in terms of cash flow and profitability but importantly, we’re getting all those things in both operations, at the same time as we’ve reached record low injury frequency rates at both operations, so that’s really pleasing,” Vassie said.

He said the company was well-placed thanks to its strong cash flow, the strong gold price, its debt reduction strategy, reduced production costs and the quality of its assets and its people.

“We’re in a really good position to consider how we substantially grow,” he said.

“It’s an exciting time in the gold industry, all gold companies are doing well and we’ve just got to maintain our focus on costs and performance and sensible growth so we don’t destroy value.”

He said at Gwalia, a series of operational improvements had maximised tonnage and reduced costs and they were yet to hit the “sweet spot” of higher grade in the orebody.

“We’re just knocking productivity out of the park, it’s just a fantastic performance in getting tonnes out of the ground there,” he said.

“The amazing thing is that back in financial year 2012, the mine produced 185,000oz and at virtually the same grade this year, we’re going to produce in excess of 260,000oz of gold from the operation.

“People think we’re getting higher grades and we’re about to, but this higher rate of production is really down to productivity.”

Vassie said mining levels had changed from 20m to 40m, the waste ore was being disposed in previously mined stopes to reduce trucking to surface, and ore passes were installed to increase tonnage.

“That allows us to run through shift changes and blasting times because we can run the loaders remotely and just tip into the ore passes, so we’re getting more tonnes per hour and more hours a day loading,” he said.

Gwalia’s ore reserve at 30 June 2015 was 1.6 million ounces at 9.4g/t gold and deep drilling from surface is building a case for an ore reserve update.

“We’ve already got a reserve life that’s the envy of our peers and to be able to extend that through deeper mining is pretty exciting,” Vassie said.

“With the drilling we’ve done during the year from surface – we’ve drilled holes more than 2200m long – they show that the orebody just continues, so the idea is to go ‘stronger for longer’.”

A highlight from deep hole GWDD17C included 1.3m at 72.6g/t gold from 2002mbs.

Vassie said further studies on deeper mining options were due in the September quarter and an investment decision would be made before the end of the year.

“We understand that we’re the deepest trucking mine in the world now, so we’re doing studies on the best way to go deeper – whether we stop trucking and become a shaft mine, or keep on trucking and introduce more ventilation,” he said.

“The way it’s looking, we’re expecting the lower capital cost of a ventilation solution will be the way to extend the minelife considerably.”

The company’s strategic review of Simberi was announced in February and St Barbara is considering divestment, joint ventures or continued development, including mining the sulphide ore below the existing oxide pit and investigating the gold oxide, sulphide and copper-gold porphyry potential on neighbouring islands.

“Simberi is outperforming and considering it produced 44,000oz in the financial year 2014, 80,000oz last year and this year it has already hit 100,000oz, we’ve made our targets which is very profitable and better than losing money, which is what we were doing before,” Vassie said.

Simberi had a sulphide ore reserve at June 2015 of 19.9 million tonnes for 1.3 million ounces of gold and the sulphide project indicates a mine life extension of eight years, according to its prefeasibility study.

St Barbara is also accelerating its exploration programs on its licences at the neighbouring Tatau and Big Tabar islands to contribute to the strategic review.

“Things are going well at Simberi and there are opportunities to further invest in PNG; but I think for a company like ours, the board needs to strategically assess whether we invest in PNG, Australia or some other foreign clime,” Vassie said.

Meanwhile the company is continuing exploration at two programs in WA, around Leonora and at Pinjin north of the gold mining hub of Kalgoorlie.

Vassie said the company had held the Pinjin prospect for some time and now had the money to explore it properly, starting with a considerable aircore drilling program.

“Suffice to say, we simply like the postcode and it’s evident there are few players in that area who like that tract of land,” he said.

“We’ll be putting quite a bit of effort into Pinjin in the coming year.”

The 1358sq.km Pinjin tenements lie east of Saracen Mineral Holdings’ Carosue Dam gold mine.

At Leonora, Vassie is keen to bring new exploration technology to look at the area under Gwalia’s headframe and continue exploration on the Centenary leases 60km north of Leonora.

“We want to really look at new ways of targeting for ore bodies that might be undercover,” he said.

On the financial front, St Barbara’s significant debt reduction has seen it re-rated by credit agencies, raised to B3 by Moody’s and to B by Standard & Poor’s.

By March 2016, St Barbara had repurchased US$82 million of its US$250 million senior secured note facility, leaving a balance of US$168 million, and Vassie noted that the remainder of the Red Kite debt facility had been paid out in June, 12 months ahead of schedule.

Aside from St Barbara’s record production levels, exploration potential and growing financial strength, Vassie is also proud of the company’s achievements in gender equity.

It was the only gold miner to be given “employer of choice in gender equality” status in both 2014 and 2015 by the Federal Government’s Workplace Gender Equality Agency (WGEA).

“Obviously there should be no pay gap at all and that’s why I look at individual roles,” Vassie said.

“I’m a WGEA pay equity ambassador and I put my hand up to that and I’m keen to talk to others about how we get there.”

Another gap Vassie would like to address is the value difference between Australian gold companies and their North American counterparts, who are trading higher.

He said credit was due to the Australian gold players who had executed well on their various growth strategies.

Now St Barbara is in a prime position to do the same.

St Barbara - At a glance

HEAD OFFICE: 432 St Kilda Rd, Melbourne VIC 3004 Ph: +61 3 8660 1900 Fax: +61 3 8660 1999 Email: info@stbarbara.com.au Web: www.stbarbara.com.au DIRECTORS: Tim Netscher, Bob Vassie, David Moroney, Kerry Gleeson QUOTED SHARES ON ISSUE: 495 million MAJOR SHAREHOLDERS: Van Eck Associates Corporation (12%), M&G Investment Mgt (10%), Hunter Hall (10%)

|