The battery supply chain research and price reporting agency said it would provide a semi-monthly update to increase the frequency of insight into the most liquid part of the lithium chemical market.

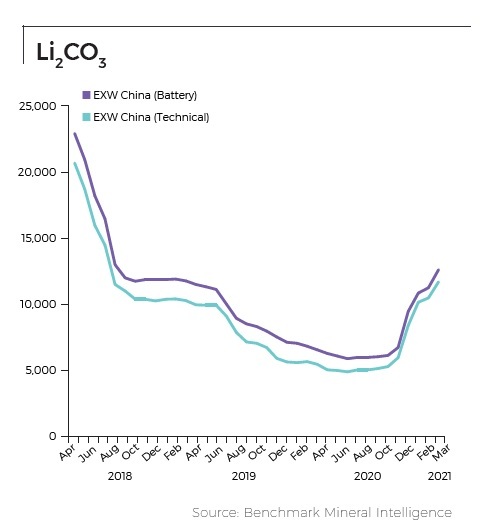

Benchmark said average pricing for EXW China technical grade lithium carbonate was up 97.5% so far this year to US$11,700 per tonne, as continuing short supply saw converters "scramble for units".

It said the battery-grade material had gained a further 12.2% in the past two weeks to be up 88.4% this year, with the average pricing at US$12,635 per tonne "on market shortage as many producers sell out of product inventory".

Lithium hydroxide had also picked up the pace, recording a 9.1% increase in the past two weeks to $9625/t.

"Market participants report to Benchmark that an increasing number of NCM 622 cathode manufacturers may look to begin to use lithium hydroxide as input if discount persists," it said.

Chinese lithium carbonate prices now hold a premium over lithium hydroxide, for the first time since April 2018, Benchmark said earlier this month.

This was due to a build-up of hydroxide capacity in China and lithium carbonate's premium was only forecast to continue in the short term, London-based commodity research firm Roskill said in December, as future demand growth for hydroxide was expected to quickly catch up with supply.

Benchmark said yesterday Chinese lithium chemicals producers, including Ganfeng Lithium, Tianqi Lithium, Youngy and Jiangte, had reached consensus in recent company announcements that the lithium chemical market was to encounter further tightness in 2021.

Benchmark's chart of the lithium carbonate price lift