The CEO of London-based precious metals trader Sharps Pixley said if the market continued to rise and the bears were forced to buy-back their loss-making position, "gold could rally very significantly from here".

"Meanwhile the extreme long positioning of the US dollar has been reduced and it only remains to see whether the gold bears are sufficiently resourced to hold out … their recent positioning suggests they are doubling up and hoping to hang on," he said.

"In short, the bears are looking vulnerable."

He said the gold price had cracked the important technical resistance at US$1215 an ounce, the trendline back to 2005, and said gold bulls would be eyeing the 200-day moving average at $1278/oz with interest.

"This would for be a worthy target for bulls," he said.

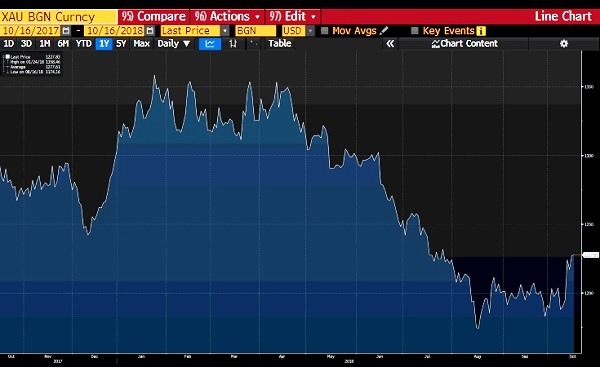

The gold price has averaged about $1277/oz over the past 12 months, reaching $1358.46/oz on the spot market in January before dropping to $1174.16 in mid-August.

It started to surge late last week from below $1200/oz amid continuing trade tensions, a weaker US dollar and a sell-off in global equities market, and was worth around $1226/oz on the spot market at the time of writing, as the Bloomberg chart below illustrates.

The gold spot price over the past year. Source: Bloomberg