The Toronto and Frankfurt-listed company has set itself apart in what is becoming a very crowded cobalt market by offering a different, more direct exposure to the burgeoning electric vehicle and power storage sectors.

When it debuted in Toronto in June, the company became one of the rare publicly traded companies focused on acquiring and holding cobalt for investment purposes.

The cash the company raised enabled Cobalt 27 to acquire 2,158 tonnes of physical cobalt, which it has every intention of holding onto in secure LME-bonded warehouses as demand for the metal soars amid rising lithium-ion battery production.

The difference between Cobalt 27 and a number of exploration and development companies rushing to gain exposure to the minor metal’s rising demand situation is risk.

“We’re the only pure-play cobalt company where you’re not taking exploration and development risk,” CEO and chairman Anthony Milewski says.

Yet, there is plenty of risk inherent in the producing cobalt space at the moment.

The Democratic Republic of Congo supplied 54% of the world’s cobalt last year, but there are worries it will not be able to replicate or build on this in future years.

Already a country renowned for political volatility that can easily turn violent, it currently has a man at the helm, Joseph Kabila, who is unwilling to give up his presidency after already serving the maximum two terms in office.

Presidential elections have been delayed from last year and there is no sign of a future polling date from Kabila, meaning nationwide unrest is on the cards and the country’s future mined output is at risk.

Also, it is worth noting that some 98% of cobalt supply is a by-product of nickel and copper mining. Supply is tied to demand and prices of the primary base metal being produced, not to the minor metal’s fundamentals.

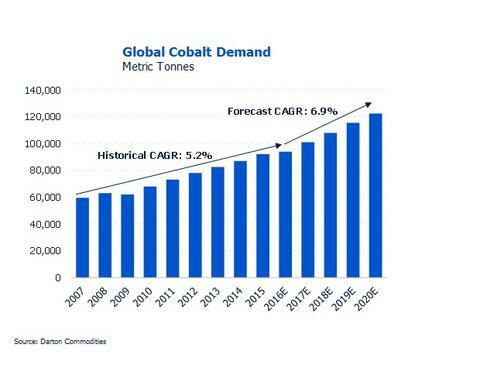

At the same time, demand for cobalt is accelerating like the electric vehicles expected to drive it.

Some 43% of demand already comes from lithium-ion batteries powering growing numbers of mobile electronic applications.

TD Securities and a host of other banks think EV demand represents a step change in future demand, with estimates that close to double the amount of cobalt supply is required to 2025 to meet the needs of a growing number of end users.

The battery facilities to serve the EV sector are cropping up in China and elsewhere, with some US$10-40 billion of investments predicated on a battery with cobalt at its core.

And, some of these factories will also be supplying batteries to the energy storage side of the market, a market gaining in prominence in power-starved regions such as South Australia.

Cobalt prices have, unsurprisingly, spiked against this backdrop. The LME price has moved up from US$24,000 per tonne at the start of 2016 to US$61,000/t at the end of August.

As a result, existing stockpiles have dwindled – the LME has less than 1,000t of readily available metal – making any physical holdings all the more precious.

It is a good time to have the largest physical cobalt position in the world outside of China, hence why Milewski says C$240 million capitalised Cobalt 27 is the “go-to name for exposure to cobalt”.

And, the company has wasted no time in leveraging this advantage.

Since acquiring that physical stock, Cobalt 27 has added seven royalties over projects in Ontario, Yukon and British Columbia to its portfolio, and listed its shares on the Frankfurt bourse, providing the company with share distribution across Europe.

It is not stopping there.

“The business expansion is two-fold,” Milewski says. “One would be the expansion into the streaming and royalty business and another potential opportunity is to buy more physical cobalt over time.”

Dilution, unlike other pure-play cobalt companies, is unlikely to be an issue here.

Every future equity raise is likely to coincide with a new physically-linked cobalt transaction. If it isn’t acquiring more stock, it will be buying up future streams or cobalt royalties, meaning the amount of physical metal per share, at least, remains the same.

Over the longer-term, the company is looking to add another string to its bow by buying interests in producing mines and/or exploration and development projects.

Such an extensive remit requires a wide-ranging C-suite, board of directors and advisory team.

Milewski is a member of the Pala Investments team and has extensive experience managing numerous mining investments across a number of commodities at various stages of development.

""We’re looking at an upheaval in the automobile market and a significant change in the energy markets, which we see unfolding over a decade"

"

President and chief operating officer Justin Cochrane brings 15 years of royalty and stream financing experience to the table, the last five as head of corporate development at Sandstorm Gold, while director Nick French is one of the most experienced cobalt traders around.

The company’s advisory board includes Dr Prabhakar Patil, the former CEO of battery maker LG Chem, and Ted Miller, senior manager at Ford responsible for the auto manufacturer’s energy storage and materials strategy.

Such experience allows the company to look at the cobalt space from a long-term perspective, evaluating what the evolution in the chemistry of lithium-ion batteries means for cobalt demand and where the next end-users are coming from.

With the EV evolution moving at such a pace, it is good to ascertain how long ‘long term’ is?

“We’re looking at an upheaval in the automobile market and a significant change in the energy markets, which we see unfolding over a decade,” Milewski says.

In 10 years’ time, annual EV sales could be upwards of 15 million, compared with just over 1 million expected this year.

Each EV, by 2025, could require around 5kg of cobalt, or close to 60,000tpa of extra demand, according to TD Securities. That represents half of 2016 mine supply.

This is on top of existing demand from a range of electronic applications and, potentially, new demand from the power storage space.

By that point, Cobalt 27’s physical cobalt exposure could be an even rarer proposition.

Cobalt 27 - at a glance

HEAD OFFICE: Suite 702, 85 Richmond Street West, Toronto, ON Telephone: +1 604 410 2277 Email: info@co27.com Web: www.co27.com DIRECTORS: Anthony Milewski, Frank Estergaard, Nick French, Jonathan Hykawy and John Kanellitsas QUOTED SHARES ON ISSUE: 24.82 million MARKET CAP (September 1, 2017): C$223.1 million MAJOR SHAREHOLDERS: Blackrock, Pala Investments, GEM

|