The zinc price has reached its highest point in 10 years, the company has strong industry backing, it has been granted a long-term mining licence and an updated feasibility study released in September points to even more robust project economics.

Citronen may not be firmly on the market’s radar yet but the Perth-based company is gaining interest from financial institutions and has strong support from major shareholders: commodities trader and miner Glencore (LN:GLEN) and global zinc smelter group Nyrstar NV (BB:NYR).

Ironbark also has a memorandum of understanding with China Nonferrous Metal Industry’s Foreign Engineering and Construction Company (NFC) for a lump sum, fixed price engineering procurement and construction contract and assistance in securing 70% debt funding.

Citronen contains 12.8 billion pounds of zinc and has an estimated 14-year minelife with production of up to 200,000 tonnes per annum of zinc.

The updated feasibility study indicates a life-of-mine revenue of US$6.36 billion, a pre-tax net present value just over $1 billion (8% discount) and an internal rate of return of 36%.

Further, the project also hosts greater potential with the company pointing out its large resource is only limited by the drilling done to date.

“For the first time ever, we’ve got all our stars aligned with regards to a very strong zinc price, the completed up-to-date feasibility study and the new 30-year mining licence,” managing director Jonathan Downes explains.

“Putting that altogether, we’re ready to start the financing and construction.”

Citronen’s estimated capital cost is $514 million, and the company is investigating various funding methods, starting with the potential 70% debt financing via NFC which gives the Chinese giant the option to acquire 19.9% of the project.

Downes described the NFC scenario as an “elegant” option to deal with construction and capital development costs and said it would also offer the fastest solution.

“But in addition to that, we are also looking at a more traditional Western finance package as well and that may also be an attractive option,” he said.

Either way, Ironbark aims to have finance locked away by mid-2018, construction underway soon after and production ramping up in 2019.

The company is no stranger to getting major European mining projects off the ground, having spun out Wolf Minerals (AU:WLF; LN:WLFE) which has started up the Hemerdon tungsten mine in the UK.

“We had a similar cap-ex number to develop Hemerdon and that was handled by primarily getting the debt settled prior to the big equity raising,” Downes said.

“This project looks like it may qualify for European Credit Authority financing, which is a very attractive way to get big projects up and running in Europe.

“I’m pretty excited by the interest the project is generating from the finance perspective and that’s primarily due to the robust economics.”

Downes said some of the key drivers in the updated feasibility study had moved strongly in Ironbark’s favour, helped by falling fuel costs, growing demand amid major mine closures and reduced smelting costs.

“Fuel prices are now about half what they were when the first study was completed and fuel is one of our biggest cost inputs, so that’s had a very good impact on cost economics,” he said.

“Also, the competition for zinc concentrate in the world has seen smelting charges considerably reduced and that’s had a positive flow-on effect into the financial model.

“We’ve seen not such a big movement in labour and material costs which has worked out quite well, the low inflationary environment we’ve been in has been positive to the company.

“The zinc price is very strong now and widely forecast to continue to strengthen from here well into next year which is very exciting, particularly when you’re trying to bring on a large, new operation.

“With these metal prices, it’s very robust to say the least – and with revenues north of US$600 million per annum (double the previous estimate), it’s a globally significant zinc producer.”

Ironbark has estimated an operating cost of $0.52/lb zinc, net of by-product credits, and smelter fees of $0.14/lb, using a zinc price modelled US$3,044/t, below the spot price at the end of September of $3,188/t.

Nyrstar and Glencore both have offtake agreements with Ironbark, each covering 35% of production from Citronen.

“We’re very proud of the partnerships we have,” Downes said.

He also had high praise for Greenland as a progressive, low sovereign risk jurisdiction and said he had encountered overwhelming local support for Citronen and enquiries about training and employment opportunities.

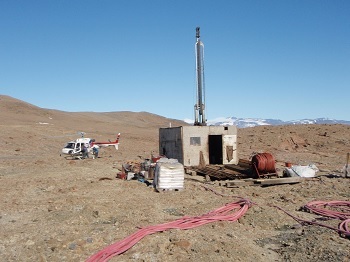

The project is expected to have a workforce of 400 with up to 270 on site at a time at the fly-in, fly-out operation.

“Greenland has built a mining school and they’re really keen to get the employment and benefits they see Australia and Canada getting from a mining economy,” Downes said.

“From a geological perspective, I think it’s a very prospective country and I think it’s a very safe and low sovereign risk environment to develop a mine.”

He said the next catalyst for growth in the debt-free company’s market capitalisation was providing clarity and proof of finance.

“I genuinely think the project has been overlooked by the market,” Downes said.

“It is a genuine project that’s had north of $50 million spent on it to get to this level and everything is coming together fabulously … so we can only go one way now.

“For the first time ever, we have secured the mining licence and we have a modern feasibility study all ready to go at once in a very strong price environment, so everything’s lined up – but we’ve fallen below the radar and I’ve certainly got my work cut out to try and get a more sensible valuation of the company because on a peer basis, it is absurd.

“It’s been a long journey but the timing has worked out exceptionally well and it really is the perfect environment to go ahead with finance and construction.”

Ironbark Zinc – at a glance

HEAD OFFICE: Level 1, 329 Hay Street, Subiaco WA 6008 PH: +61 8 6461 6350; FAX: +61 8 6210 1872 Email: admin@ironbark.gl Web: www.ironbark.gl DIRECTORS: Jonathan Downs, Peter Duncombe Bennetto, David Kelly, Gary Comb, Jason Dunning QUOTED SHARES ON ISSUE: 539 million MARKET CAP (at 29 September): A$46.4 million MAJOR SHAREHOLDERS: Nyrstar NV 19%; Glencore 9%; Board and management 5%; Top 20, board and management 45%.

|